Fundamental index funds are a fairly new approach to index investing. The idea was first brought to my attention by Andrew Hallam, the author of Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School. Fundamental indexing is an idea that intrigues me but I have not been fully sold on it as of yet. I do not hold any fundamental index ETFs but may decide to add some to my portfolio in the future. I have contacted Andrew Hallam about his current strategy with regards to the fundamental index funds and he has stated that he is "adding them to [his] portfolio, but not selling what [he has] to do so". This is a strategy that I would reiterate if someone was deciding to add these funds to their portfolio.

Fundamental index funds are a fairly new approach to index investing. The idea was first brought to my attention by Andrew Hallam, the author of Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School. Fundamental indexing is an idea that intrigues me but I have not been fully sold on it as of yet. I do not hold any fundamental index ETFs but may decide to add some to my portfolio in the future. I have contacted Andrew Hallam about his current strategy with regards to the fundamental index funds and he has stated that he is "adding them to [his] portfolio, but not selling what [he has] to do so". This is a strategy that I would reiterate if someone was deciding to add these funds to their portfolio.

The Great Debate:

Should I hold index stocks in proportion to market capitalization (% of the index that is taken up by the company's shares) or fundamentals (various other financial measures) such as cash flow, valuation, dividends, sales and/or book value?

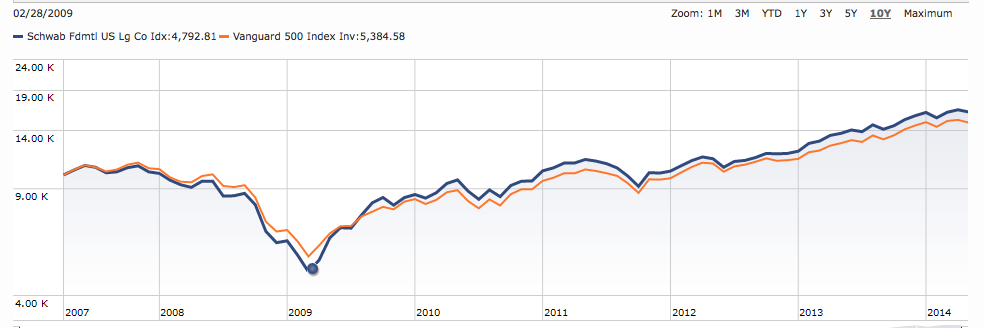

Overall, it seems that fundamental index funds MAY actually beat traditional (market cap.) index funds but only over a period of many decades. Proponents of fundamental indexing will show you specific examples of fundamental index funds beating market cap. index funds. For example, Schwab Fundamental U.S. Large Company Index (ETF ticker symbol = FNDX) has beaten the Vanguard 500 Index (ETF ticker symbol = VFINX). There are couple of things to consider with this comparison. FNDX has holdings from 634 large U.S. companies based on three fundamental measures of company size: retained operating cash flow, adjusted sales, and dividends plus buybacks. The expense ratio of FNDX is 0.32%. VFNIX is based on the S&P500 and invests in the 500 largest U.S. companies based on market capitalization. VFNIX expense ratio of 0.17%. Also, if you look at the graph below, you will notice that the Schwab Fundamental U.S. Large Company Index dropped 52% in 2008-2009 when the S&P 500 dropped only 46%. The fundamental index wins the battle in the long-run but with an increased expense ratio (additional 15% for FNDX) and periods where it lags market cap. index funds, the difference is very small between the two funds.

Comments - Ask questions and/or provide feedback below!

*you can comment as a guest without registering/signing in by clicking on the 'Name' box below and checking the 'I'd rather post as a guest' box. If you don't feel comfortable providing your own email, you can just make one up (e.g. fakeemail@gmail.com).

DIY Canadian: How-To Guides for Canadians

DIY Canadian: How-To Guides for Canadians