Q: OK, I've decided to open an account with TD so that I can invest in the TD e-series index funds. How exactly do I do that?

In order to open a TD Direct Investing account, you must visit a TD branch (either TD Canada Trust, which is the regular bank, or TD Direct Investing, which is a brokerage). I recommend opening up a TD Direct Investing (aka TD Waterhouse) account when opening a TFSA, but it is fine to do this by going to a TD Canada Trust branch. Just make sure you mention that you want a TD Direct Investing account! If you want to know why I recommend a TD Direct Investing over a TD Canada Trust account and in which situations I don't, click here.

Anyways, without further ado, here is...

OFFICAL ![]() DIY CANADIAN HOW-TO GUIDE: Opening a TD Direct Investing Account and buying a TD e-Series fund

DIY CANADIAN HOW-TO GUIDE: Opening a TD Direct Investing Account and buying a TD e-Series fund

- You CAN begin by completing an application for a new account by clicking on the account you wish to open and following the subsequent steps. You can start here.

- However, this is not a NECESSARY step and can be bypassed since you will still have to go into a TD Branch to open the account. It is just supposed to provide information to the TD Advisor so that you don't have to give him/her this information when you meet. The problem with this is that the TD Advisor often starts a new application and asks you for this information all over again anyways in my experience.

- Call to set-up an appointment with a TD Advisor at a TD Branch close to you in order to complete the application process

- You can call them at 1-800-465-5463 OR at 1-866-666-6178. There are investment representatives available 24/7 to take your call.

- If you provide the investment representative with your postal code when you call them, they can find the nearest TD Branch for you (it does not matter if it is a TD Canada Trust or TD Direct Investing Branch).

Visit a TD to meet with a TD Advisor. *make sure you bring 2 pieces of ID, your SIN # and a VOID cheque

Visit a TD to meet with a TD Advisor. *make sure you bring 2 pieces of ID, your SIN # and a VOID cheque

- To open an account, you will need to provide the TD Advisor with two pieces of identification that includes one valid government issued photo ID (e.g. Driver's licence or passport) that they will photocopy and a secondary piece, which can be a credit card (e.g. VISA, MasterCard).

- You will need to have your Social Insurance Number ready as well.

- Have a VOID cheque handy (if your regular bank account is not with TD) or anything that has your banking information on it (account #, institution #, etc.) so that the TD Advisor can link your bank account information to your new investment account

- Make sure that you sign up for e-Services (e.g. e-statements) when registering for a TFSA so that you avoid any additional fees charged to your account. Tell the TD Advisor you want to do this. It can also be done on WebBroker after your account has been initialised.

- You will usually have to do a 'risk tolerance' questionnaire. I recommend that you state that you are willing to take risks and your investment timeline (when you need the money) is many years down the road. This avoids any conflicts where the e-series funds don't 'match' your risk tolerance questionnaire, which possibly puts your account on hold until you call a TD investment representative to confirm you understand the risks of TD e-series funds.

- Be prepared for the TD Advisor to try to sell you on some mutual funds with high MERs/other services that you do NOT need. They are after all looking for some commission money. Don't let them convince you!

- This meeting should take between 20-30 minutes

- WARNING: Make sure to check over important information to ensure that is correct before the TD advisor submits the application. IF they input incorrect information (e.g. phone number, birth date, etc.), which happens more often than it should, you will have to go back to the TD branch in person to sign off on the changes. Based on my own personal experiences, this is definitely not worth the hassle. So make sure to check everything over even if the TD advisor doesn't prompt you.

- Time to wait! It should take a maximum of 5 business days for the new account application to be finalized. If this is the first account that you have opened at TD Direct Investing, then you will have to wait another couple of business days to receive a letter in the mail OR an email (depending on your preference) that has your WebBroker Connect ID and temporary password.

- If after 7 business days, you have still not received anything from TD, then check to make sure that there were no issues with your application. Often the TD Advisor that you speak to at the TD Branch will forget to input important information and the application status will be left as 'incomplete'. You should not count on TD to call you about this in my personal experience. Be proactive and check to make sure everything is moving along smoothly with your application.

- If you have already opened a TD Direct Investing account before and have access to WebBroker, then you will not need to wait for a letter in the mail OR email since you already have a WebBroker Connect ID. You should be able to login to your online account and see the new account after your application has been finalized (max 5 business days).

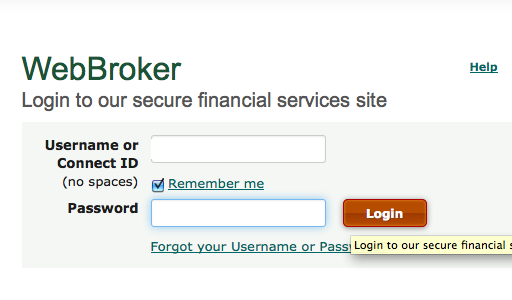

- Login to WebBroker with your Connect ID and password.

- Click on 'Account Details' on the left side of your screen to see a summary of your accounts. You should see your account there and it should indicate what type of account it is (e.g. Registered CDN TFSA).

- If you are planning to set up a MCP (monthly contribution plan) and a SIP (systematic investment plan) as the sole means to investing then you can skip the following steps and begin setting this up. Click here to find out how.

- Fund your account.

- You do not need to worry about having to do this quickly because you think your account will be shut down if there's no money in it. As long as there is some activity (e.g. money deposited) in the account within 2 years of opening, then the account will stay opened.

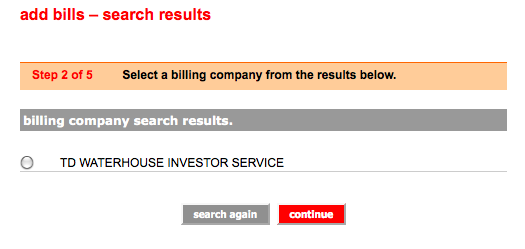

- This can be done using the 'bill payment' feature using

your online bank account. If you have a PC Financial chequings account, then you can click 'add bills' and search for 'TD Waterhouse' in the 'billing company's name' search bar. Type in your account number, which is 7 alpha numeric characters (can be found under 'Account Details' in your WebBroker account). Once the bill has been added, go back to 'Bill Payment' and type in the amount of money you wish to add to your TD Direct Investing account. It usually takes about 3 business days for the money to show up in your account.

your online bank account. If you have a PC Financial chequings account, then you can click 'add bills' and search for 'TD Waterhouse' in the 'billing company's name' search bar. Type in your account number, which is 7 alpha numeric characters (can be found under 'Account Details' in your WebBroker account). Once the bill has been added, go back to 'Bill Payment' and type in the amount of money you wish to add to your TD Direct Investing account. It usually takes about 3 business days for the money to show up in your account. - Alternatively, you can set up a MCP and SIP. Follow the steps on this page to do this.

- Now you can buy TD e-Series funds! (or other securites, e.g. stocks, ETFs, etc.). For more information on which TD e-Series funds you should buy, click here.

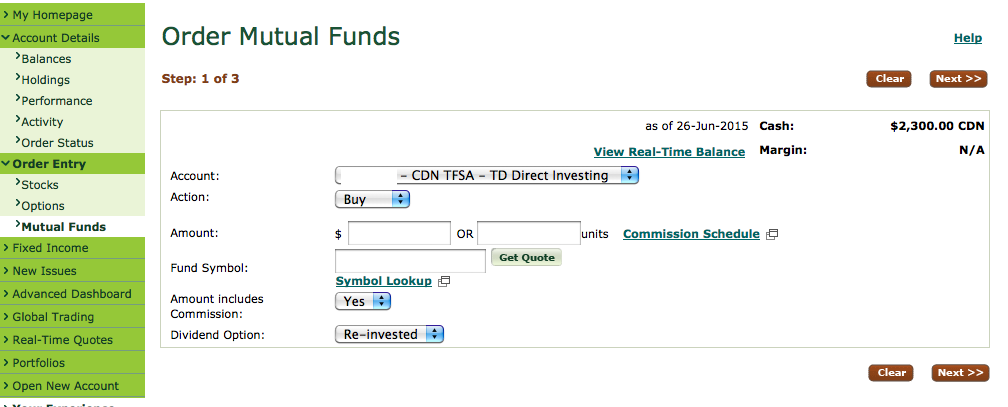

Click on 'Order Entry' on the left side of your screen and then click 'Mutual Funds' from the drop down menu if you are planning on buying TD e-Series funds.

Click on 'Order Entry' on the left side of your screen and then click 'Mutual Funds' from the drop down menu if you are planning on buying TD e-Series funds.- Select 'Buy' from the drop down menu and type in the $ amount that you wish to spend on a particular TD e-Series fund.

- Type in the TD Fund Symbol (e.g. TDB900 for the TD Canadian Index e-Series Fund) and 'get a quote' to make sure that it is the fund that you wanted to buy.

- If you want to reinvest your dividends (money paid to a company's shareholders from their profits) then put 're-invested' as your dividend option. I highly recommend this! Keep the 'amount includes commission' setting set to 'Yes'.

- Click 'Next', check off the boxes, review your purchase and enter your trading password to finalize you investment purchase.

- Wait for the trade to finalize.

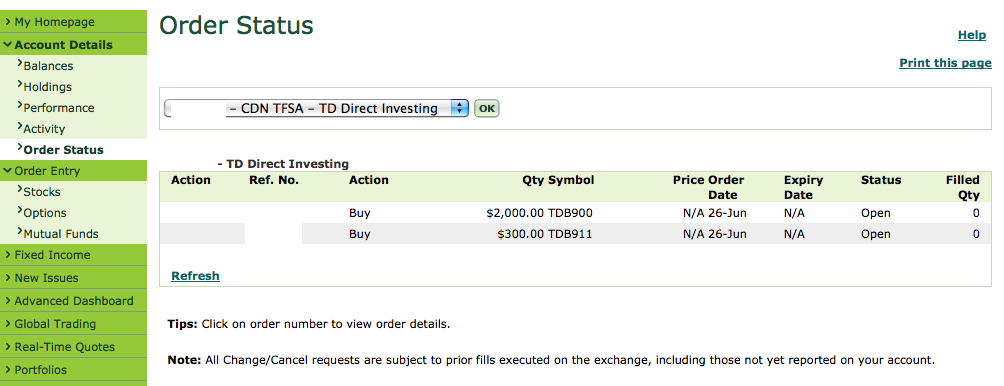

- This will take 2-3 business days and you can check to make sure your order was placed on 'order status'. 'Open' status means that your trade has not been filled (finalized).

- Check to see that your 'holdings' (under account details) include the fund that you purchased and that you now have money in 'securities' rather than 'cash'. Once you see this, you're officially done!

Comments - Ask questions and/or provide feedback below!

*you can comment as a guest without registering/signing in by clicking on the 'Name' box below and checking the 'I'd rather post as a guest' box. If you don't feel comfortable providing your own email, you can just make one up (e.g. fakeemail@gmail.com).

DIY Canadian: How-To Guides for Canadians

DIY Canadian: How-To Guides for Canadians