*Note: the information below has been updated for 2018 (last update: March 2018)

Q: What is a TFSA?

A TFSA is the first place you should be putting any money you have saved. I believe the RRSP should come second unless you are in a very high income tax bracket.

In Canada, a Tax-Free Savings Account (TFSA) is a registered investment vehicle available to anyone who is 18 years of age or older and who has a valid social insurance number. Unlike an RRSP, contributions to this 'tax shelter' are not tax-deductible. You must use after-tax income to make your contributions and so there will be no deductions come income tax time (as is the case with an RRSP). The benefit of the TFSA comes with the fact that any investment income/interest earned inside the TFSA will not be taxed AND you can withdraw this money at anytime without penalties. So even if you aren't saving for retirement, it makes sense to keep any additional money you have laying around inside a TFSA.

So isn't it like the exact opposite of an RRSP? Kind of! You don't have to pay tax on money that goes into an RRSP (such as employment income that would normally be taxed), but you are taxed when you take money out since it counts as income at that time. TFSAs on the other hand work in reverse. The money that you put into a TFSA will have been taxed prior to your contribution (if it's money you made from your job), but there will be no taxes any money taken out of your TFSA and it will NOT count as income (so it doesn't affect EI, Old Age Security, etc.).

Q: Where do I go to open up a TFSA?

TFSAs are available at almost all major banks and brokerages. Once your money has been put into a TFSA, it is up to you to decide what to do with the money in order to take full advantage of its benefits. The idea is to make money off your money. You can do this with a high-interest savings account, GICs, mutual funds, ETFs (exchange traded funds), stocks, bonds, etc. Technically you can have multiple TFSAs as long as the combined amount of money from all accounts does not exceed your contribution limits (unless you feel like paying a fee). Just make sure that if you move money between TFSAs that you are transferring the money and not withdrawing and then depositing the money (unless you feel like paying fees again). To do this, ask for a "direct transfer" from your bank/brokerage.

*WARNING: Each bank/brokerage will have their own investment, administration and other fees and it is important you do your research so you aren't surprised by any 'hidden costs'.

Q: How much can I contribute?

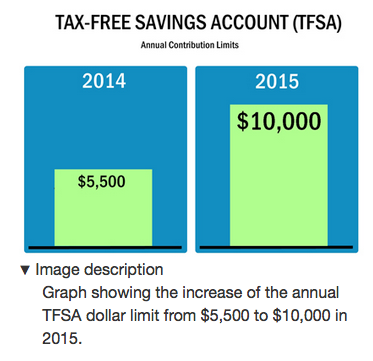

When an individual turns 18, they can contribute the full annual contribution limit for that given year. The annual contribution limit in 2009 and up to and including 2012 was $5,000, followed by $5,500 for 2013 and 2014, $10,000 for 2015, and $5,500 for 2016 and beyond.

Even if someone has a birthday in November of a given year, they would be able to contribute the same amount as someone who's birthday was in January since they were both born in the same year.

OK, so how much room do you have? Even though I am an old man (or feel like it anyway) and turned 18 well before 2009, my contribution room starts from 2009 since TFSAs didn't exist before then. So had I not already made contributions, I would have the maximum allowable contribution room for a TFSA. To calculate my total TFSA contribution room, I would multiply $5,000 by 4 (for 2009, 2010, 2011 and 2012), add $5,500 multiplied by 2 (for 2013 and 2014), $10,000 for 2015, and then add $5,500 multiplied by 3 (for 2016-2018). Therefore, my total contribution room in 2018 would be $57,500 if I had not contributed to my TFSA previously.

Keep in mind that money that is gained OR lost inside of a TFSA does not affect the TFSA contribution limit for the following year. So just because your investments 'bomb' and you lose $3,000 of the $5,500 you contributed that year, does NOT mean that you can add another $3,000 to the remaining $2,500 in your account. The only time that contribution rooms will be affected is if you withdraw money. This is discussed in one of the questions below. You will also not be able to claim 'capital losses' to reduce your tax liability like you would in an unregistered account. What did you expect? You can't have your cake and eat it too!

*WARNING: Make sure you don't over contribute to your TFSA or a tax of 1% on the excess contribution will be applied. If your contribution limit is $5,500 and you contribute $10,500, then you will pay a monthly tax of $50 ($10,500 - $5,500 = $5,000 excess). So it's possible to have a tax applied to a Tax-Free Savings Account? Yes it's as stupid as it sounds. So don't do it or you will be defeating the purpose of opening a TFSA.

Q: OK, I think I understand how much contribution room I have... But just to be on the safe side, is there somewhere I can go to confirm the exact amount of room I can contribute to my TFSA?

Yes there is! And it is a good place to check out even if you have made contributions in the past as it gives a detailed transaction summary as well. You will need to create an account with the CRA but once you have done this, you will be able to determine the amount of money you can add to your TFSA without being penalized. Click here (https://www.canada.ca/en/revenue-agency/services/e-services/e-services-individuals/account-individuals.html) to get started.

Q: When can I contribute?

You may deposit money into a TFSA at any time during the year once you have turned 18. All unused contributions will be carried forward indefinitely so there is no pressure to get the money in before a certain date.

Q: What if I want to take money out of my TFSA?

Taking money out of your TFSA is called a withdrawal. There are no penalties for taking money out of a TFSA and you may do so at anytime. However, the broker/bank in which your TFSA investments are held may have fees that you should pay attention to.

Whatever amount of money you withdraw from a TFSA in a given year can be added back to the TFSA in the following year. So if in 2015 you took $5000 out of your TFSA, you could add that amount back to your TFSA in addition to any unused contribution room you have in 2016. This means that if your investments do well and make you money, then in effect they will permanently increase your contribution room if you were to ever withdraw that money. Here's an example... Jack turned 18 in 2018 and the annual contribution limit is $5,500. He put $5,500 dollars into his TFSA immediately and made $5,000 in investment income from his contributions over the course of the year. He decided to withdraw all $10,500 at the end of the year (still 2018). Jill also turned 18 in 2018 but decided to wait until 2019 to put her money into the bank. In 2019, Jill would be able to contribute $11,000 to her TFSA. However, since you are able to re-contribute whatever amount you withdraw from your TFSA, Jack is actually able to contribute $16,000 in 2019 ($5,500 annual contribution + the $10,500 he withdrew in 2018).

Q: So now that I have my money in the TFSA, what should I invest in?

Once again, it depends on your current situation and short-term/long-term goals (e.g. age, major purchases in the near future such as a house, retirement, etc.). If you’re able to invest in your TFSA for the long-term, higher-growth investments are most suitable since the dividends and growth are never taxed in a TFSA. Index funds (specifically TD e-Series funds and ETFs), which are discussed on other pages, are considered to provide the best long-term growth for your money. However, since your money is at the mercy of the stock market in these types of investments, it may not be wise for someone who needs to make sure they have money in the short-term (e.g. need money for retirement that is looming, home purchase, etc.). In that case, it would make sense to use safer investments that are not as risky and are less of a roller coaster ride for your money. Savings account, bonds and GICs would serve this purpose.

*IMPORTANT: If you have analyzed your situation and decided that you are going to have a combination of stocks/index funds/ETFs AND investments that accumulate interest (e.g. GICs, bonds, savings accounts) then it would make the most sense to have the latter in the TFSA. Interest is generally taxed at a higher rate than capital gains or dividends that you accumulate from stock market investments. Therefore, it makes sense to keep them sheltered inside your TFSA where interest CAN'T be taxed.

If you have decided that you want to invest in equities such as index funds then a good starting point is TD e-Series funds. I personally use the TD e-Series funds because it is easy to set up a Monthly Contribution Plan (MCP) and Systematic Investment Plan (SIP) with the TD e-Series funds. This will make your investing automatic and stress-free! TD e-Series funds also have fairly low fees (MERs) especially when compared with traditional mutual funds.

However, as great as the TD e-Series funds are, Exchange-Traded Funds (ETFs) are even better as they have even lower fees (MERs). The downside with them (when comparing to the TD e-Series funds) is that they require a little more work since they have to be purchased on the stock market when the stock market is open (9:30 am to 4:00 pm). Is it that difficult to do? Absolutely not! But it requires you to do a bit more research to make sure you are comfortable using an online trading platform to buy ETFs (through TD Direct Investing or Questrade). You will want to learn what ticket symbols are (e.g. VCN.TO, VTI, VXUS, etc.), the difference between limit and market orders, open (or accepted) vs. filled (or executed) orders, bid/ask prices, trading commissions, ECN fees, etc.

It is recommended that as your TFSA portfolio increases in value, that you begin to sell some of your TD e-Series funds that were automatically invested (through your MCP and SIP) and then use the money from that sale to buy ETFs to take advantage of the lower fees. There is no cost to selling your TD e-Series funds. There can be a cost for buying ETFs (if you are at TD, there is a $9.99 commission for each ETF purchase) but some brokerages offer free ETF purchases (such as Questrade). How exactly would you make the switch? Keep reading below!

Q: I like the convenience of buying TD e-series funds automatically through a Monthly Contribution Plan (MCP) and Systematic Investment Plan (SIP), but want to also enjoy the lower MER (aka fees) associated with buying ETFs and don't want to pay commissions for buying ETFs. Is it possible to have the best of both worlds?

Yes it is! There are two possible ways that I would convert from TD e-Series to ETFs (which I have described as Option 1 and Option 2 below). This information is also included on the Investing 101 webpage.

Option 1 (My Preferred Option): Buy ETFs through TD Direct Investing

Sell your TD e-series funds (make sure you don't sell any units that have been purchased in the last 30 days to avoid early redemption fees of 2% of the purchase cost of the funds sold within 30 days of purchase) then buy ETFs at TD with the money from your TD e-series funds. This ensures that your TFSA is all in one account with TD. The downside is that TD charges a $9.99 commission for each ETF purchase. So for the 3 ETF portfolio that I use, I would be charged approx. $30 each time I decide to buy ETFs ($9.99 multiplied by 3). This is the more convenient option (less hassle) but is also a bit more expensive.

Sell your TD e-series funds (make sure you don't sell any units that have been purchased in the last 30 days to avoid early redemption fees of 2% of the purchase cost of the funds sold within 30 days of purchase) then buy ETFs at TD with the money from your TD e-series funds. This ensures that your TFSA is all in one account with TD. The downside is that TD charges a $9.99 commission for each ETF purchase. So for the 3 ETF portfolio that I use, I would be charged approx. $30 each time I decide to buy ETFs ($9.99 multiplied by 3). This is the more convenient option (less hassle) but is also a bit more expensive.

*Your results may vary, but you can negotiate with a TD Direct Investing representative to apply a credit for you for the $9.99 commissions on your future ETF purchases in order to keep your business at TD (you can use the threat to transfer to Questrade where there are no commissions for buying ETFs). Keep in mind that the first TD representative that you speak to will likely offer you 50% off of your ETF commissions at TD (so you would pay a 4.99 commission for each ETF purchase instead) and will be unable to give you a better deal. Ask for a manager and they will have the ability to give you a credit that will negate the entire commission of your ETF purchases. I have been able to get a $39.96 credit applied to my account prior to purchasing ETFs as I said that I will be buying 4 ETFs ($9.99 multiplied by 4 is $39.96). This ETF commission credit will NOT count as a TFSA contribution so you do not have to worry about this wasting some of your valuable contribution room. If you are able to successfully negotiate a commission rebate, then this option is by far the best choice. If not, consider option 2 below.

As an added benefit to keeping my TFSA at TD Direct Investing rather than Questrade, I will increase my investment portfolio diversification slightly. I already have money invested in a RRSP and a non-registered account at Questrade. Ensuring that not all of my investments are with one brokerage will provide additional safety (mainly as protection against the very remote chance that one of these brokerage's fails or goes bankrupt).

Option 2: Buy ETFs through Questrade (After a Transfer or Withdrawal from TD)

Sell your TD e-series funds (once again make sure you don't sell any units that have been purchased in the last 30 days to avoid additional fees) then open a TFSA account with Questrade.

Sell your TD e-series funds (once again make sure you don't sell any units that have been purchased in the last 30 days to avoid additional fees) then open a TFSA account with Questrade.

Transfer the money from the sale of your TD e-series funds to Questrade. The reason that I have bolded the word transfer is because if you transfer your money from one brokerage to another, then it will not appear as a withdrawal from your TFSA. This will allow you to buy ETFs immediately once the money appears in your account at Questrade. If you withdraw money from your TFSA at TD and then deposit it into your account at Questrade, the Canadian government will view that as an overcontribution to your TFSA and you will incur a penalty tax on that overcontribution (assuming you went over the maximum allowable room in your TFSA).

Questrade will reimburse the transfer fee (up to $150) that TD will charge you for transferring investments or money (in this case it would be money as you can't transfer TD e-Series funds because Questrade doesn't offer them in their accounts) in your TFSA over to Questrade IF the account being transferred is worth $25,000 or more. This fee will be $135 + tax. Questrade will only reimburse the transfer fee once per client and this reimbursement could be used on any account (e.g. TFSA, RRSP, non-registered account). You can transfer all or part of of your account at another financial institution (TD Direct Investing in this case) to Questrade. You can transfer the account 'full in-cash' (all funds in cash), 'full in-kind' (all assets i.e. cash and securities), 'partial in-cash' (portion of funds in account in cash) OR 'partial in-kind' (portion of assets i.e. cash and securities). 'In-kind' means the securities (e.g. ETFs, mutual funds, etc.) would be transferred without a sale. This can only be done if both the sending and receiving brokerage allow the same security to be held in their investment accounts.

For a TFSA, transferring in-kind could be useful if you already hold ETFs as it means you don't have to sell them at TD Direct Investing (costs commission + ECN fees) and then re-buy them with Questrade. This will be possible if the receiving brokerage (Questrade) offers the same investments as the sending brokerage (TD Direct Investing). For example, both brokerages would offer all of the same ETFs and so if you hold ETFs in a non-registered account at TD, you could transfer them to Questrade without having to sell them. It also means that your investments will stay in the market during the entire transfer period (since they will be held in the ETFs the whole time) so you won't miss out on any gains.

*Note: There are no capital gains taxes when you sell investments in a TFSA (or RRSP for that matter as long as you don't withdraw the money) so you don't need to worry about having to pay any taxes when selling investments within a TFSA (unlike a non-registered account).

To do a direct transfer of your accounts between TD Direct Investing and Questrade, you could use the “Broker to Broker” transfer option in the funding menu. You can find this by logging into myQuestrade under 'Funding' and then clicking on 'Transfer account to Questrade'. Next, you would have to fill out that transfer form and upload the form to initiate the transfer. Once this is uploaded (to upload you can go to my.questrade.com, click on Account Management and then click on Upload document), Questrade will initiate the transfer process on your behalf. This process can take 10-20 business days to complete.

Once you have exhausted your one time reimbursement on the transfer fee, it will not make sense for you to continue doing transfers in the future (since the fee is so high at $135 + tax) for a TFSA. However, that doesn't mean you can't move your money from one brokerage account to another. You will have to do it through a withdrawal/deposit to avoid the transfer fee.

If you are at your maximum allowable TFSA contribution room when you make a withdrawal from your TFSA, that money cannot be put into another TFSA account (or even put back into the same TFSA account) in the same year as it will appear (to the Canadian government) as an overcontribution to your TFSA. You must wait until next year to avoid penalties associated with overcontributing to a TFSA (as the withdrawal becomes contribution room for the next year). The ideal time to make a withdrawal from your TFSA (e.g. at TD) would be at the end of December and then you could deposit the money into another TFSA account (e.g. at Questrade) without incurring any penalties.

Q: So I set up a MCP and SIP with TD Direct Investing to buy TD e-Series Funds. I am ready to buy ETFs now. Which ETFs do you recommend for a TFSA account?

Unlike the 3 ETF portfolios that I use for my RRSP and non-registered (taxable) investment accounts, I do not hold US-listed ETFs in my TFSA.

One of the reasons for this is that TFSAs do not get the 15% foreign withholding tax exemption like a RRSP does so there isn't any advantage to holding a U.S. listed ETF in a TFSA. In fact, U.S. listed ETFs can actually be less tax efficient in a TFSA so you want to avoid them in this case. Since in a TFSA the foreign withholding tax is not exempted (as in a RRSP) and is not recoverable (as in a non-registered account), it is often said that Canadian equities are the most tax efficient in a TFSA. This is why my exposure to the Canadian markets is the highest in my TFSA.

Another reason for not holding US-listed ETFs in my TFSA is that in order to avoid being charged awful hidden currency conversion fees by brokerages (e.g. Questrade charges around 1.5-2%) when changing my money from CAD to USD to buy US-listed ETFs, I would have to do Norbert's Gambit. This isn't a huge deal, but this means that you would have to buy the DRL.TO ETF and then sell the DLR.U.TO ETF to complete the gambit. These ETF transactions will cost money (through commissions) and since I prefer to keep my TFSA in its entirety at TD Direct Investing (which doesn't have free ETF purchases), it becomes even less advantageous to buy US-listed ETFs in a TFSA. So in the end, all of the ETFs in this TFSA portfolio can be purchased in CAD without any of the extra hassle of converting it to USD!

Alright, alright. Get to the point already... What ETFs should I buy?

I use a 4 ETF portfolio that is largely based on Justin Bender's Canadian Portfolio Manager blog model ETF portfolio for TFSAs (who works closely with the Canadian Couch Potato himself, Dan Bortolotti) with a difference in allocation.

I didn't go with the Canadian Couch Potato model portfolio (which I still love and think is great for certain types of investors) because Dan only uses 1 ETF to cover both US and International markets (iShares Core MSCI All Country World ex Canada Index ETF, XAW) so I can't choose the exact allocation of US vs. International exposure. Justin Bender also does a great job of considering both the MER and foreign withholding taxes in deciding on ETFs (and beats Dan's model portfolio in this regard) and that's why I have modelled my portfolio after his even if it is a bit more complex than Dan's Canadian Couch Potato portfolio.

It's also worth noting that since investments in a TFSA are not subject to taxes as they grow (e.g. tax on dividends), I do not need to worry about calculating the ACB like I would with a non-registered account (you also don't need to worry about calculating ACB in a RRSP either since you don't pay taxes as your investments grow even though you will eventually pay a tax when you withdraw money). This is another reason I feel justified in going with a more complex portfolio in my TFSA since I won't have to worry about the bookkeeping that would go along with a non-registered portfolio of the same ETFs.

When compared to Justin's model ETF portfolio, the difference comes with my allocation. I allocate 35% to the Canadian ETF, 35% to the US ETF and 30% total to the 2 International ETFs (covering Europe, Australasia and Far East aka EAFE and Emerging Markets such as China, Taiwan, South Korea) in order to match it up with my TD e-Series fund allocation.

My TFSA ETF Portfolio

- Choose One Of: Vanguard FTSE Canada All Cap ETF, VCN (35% of portfolio) *MER = 0.06% OR BMO S&P/TSX Capped Composite Index ETF, ZCN (35% of portfolio) *MER = 0.06% *my preference is VCN.TO

- iShares Core S&P U.S. Total Market Index ETF, XUU (35% of portfolio) *MER = 0.07%

- iShares Core MSCI EAFE IMI Index ETF, XEF (24% of portfolio) *MER = 0.22%

- iShares Core MSCI Emerging Markets IMI Index ETF, XEC (6% of portfolio) *MER = 0.26%

*All of the ticker symbols above can also have CA added to the end of them when trading at TD Direct Investing (e.g. VCN CA, XUU CA, etc.). Don't be thrown off by that!

*personally, I would also sign up for a DRIP (Divident Reinvestment Plan) for each ETF once you have purchased the ETFs and the trades have settled (takes 2 business days). This will automatically reinvest any dividends earned through your investments (IF the dividend is large enough to purchase whole shares, otherwise, extra cash will be deposited into your account) so that you keep more of your money in the market and avoid trading commissions (ECN fees). If you don't sign up for a DRIP, your dividends will always be deposited into your account as cash and so they won't have a chance to earn more money in the market until you manually buy additional investments with the money.

There are no fees or commissions involved with the DRIP service at TD Direct Investing. I repeat, you will not be charged a commission when shares of an ETF are purchased through a DRIP at TD Direct Investing (which is a big bonus since normally you would have to!).

In order to set up the DRIP for your ETFs, you must hold the ETFs in your account you want to do this with and the ETF trades you placed need to be 'settled'. The settlement date is the trade date (when the ETF order was filled) plus two business days so if you bought the ETFs on a Friday, then they would be settled on the Tuesday. Once the ETFs have settled, you can choose to do a "blanket" DRIP in which all ETFs that you hold will be enrolled in the DRIP program (recommended), or you can pick and choose which ETFs to enroll.

You will have to call to speak to a TD Investment Representative at 1-800-465-5463 or 416-982-7686 (unlike Questrade in which you need to fill out a form) in order to set up the DRIP after the trade settles. You will be able to call at any time during the day to to this (open 24 hours, 7 days a week).

Q: What should I do with the extra cash in my account?

If you are buying ETFs through Questrade, you can use the spare cash in your account to buy additional ETF shares as long as you have enough money to buy at least one share of an ETF. There is no reason not to do this since there are no commissions for buying ETFs at Questrade.

If you are buying ETFs through TD Direct Investing, it generally does not make sense to buy additional ETF shares with your spare cash unless you have a lot of it sitting in your account. This is because it will cost you $9.99 commission for each ETF purchase at TD (unlike the free ETF purchases at Questrade). However, as a workaround that allows you to get your money in the market without paying extra fees, you can then use the spare cash in your account after making your ETF trades to purchase TD e-Series funds that don't charge commissions for buying/selling. You will have to make sure that you have at least $100 (minimum amount to buy if not through a SIP) in order to place an order for a specific TD e-Series fund.

Comments - Ask questions and/or provide feedback below!

*you can comment as a guest without registering/signing in by clicking on the 'Name' box below and checking the 'I'd rather post as a guest' box. If you don't feel comfortable providing your own email, you can just make one up (e.g. fakeemail@gmail.com).

DIY Canadian: How-To Guides for Canadians

DIY Canadian: How-To Guides for Canadians