Q: OK, I'm ready to buy (or sell) TD e-series funds! So how exactly do I do that?

Note: If you are considering buying a large number of shares of TD e-series funds (which are considered mutual funds) in November or December, you may want to wait until the new year (e.g. January) to purchase the funds. The reason for this is that mutual funds often pay a capital gains distrubtion at the end of the year, and a new investor must pay the full year's tax on it even though they didn't hold the fund for most of the year. You shouldn't need to worry about this if you are buying ETFs since they are much better at eliminating taxable gains. Read this webpage by the Canadian Couch Potato for more information about this.

One of the advantages of using TD e-series funds over ETFs is that it is a much easier process to buy and sell. You also do not need to worry about the time of day or day of the week that you buy TD e-series funds unlike ETFs.

Keep in mind that for buying, the minimum amount required for initial and subsequent trades for TD e-series funds is $100. So you can't invest less than $100 into any one TD e-series fund directly through WebBroker (TD Direct Investing's online trading platform). However, if you set up a SIP (systematic investment plan) you will be able to invest a minimum of $25 into a TD e-series fund.

It is also important to note that TD e-series index funds have 30 day 'holding periods'. This means that if you sell units of a TD e-series index fund that you purchased within the last 30 days, you will be charged an additional fee (2% early redemption fee). Any units that have been held for longer than 30 days are free to sell.

Q: Should I buy/sell TD e-series funds during market hours (between 9:30 a.m. and 4 p.m) like I do with ETFs? Can I order TD e-series funds in the evening and on weekends?

Unlike ETFs, you do not need to be very concerned about the time of day or day of the week that you buy/sell the TD e-series funds. Just like mutual funds, the TD e-series funds are only bought and sold once per day and are bought at the 'end of day' price. If you order your TD e-series funds before 3 pm, then you will get that day's 'end of day' price. If you order the TD e-series funds after 3 pm, then you will get the 'end of day' price for the next business day. So if you order your TD e-series funds at 3:30 pm on Friday, then you will get the 'end of day' price on Monday since that is the next business day.

Keep in mind that your order will not be 'filled' right away (it will stay 'open' until between midnight and 9 am the next day) but when it does go through, it will have the 'end of the day' price for either the day you placed the order (if placed before 3 pm) or the next business day (if placed after 3 pm). So the only advantage of placing the order during market hours is that you would have an idea of which direction the market is going that day. However, this is not something that I would recommend anyone concern themselves with. Feel free to order the TD e-series funds at night or on weekends without worry.

OFFICAL ![]() DIY CANADIAN HOW-TO GUIDE: Buying TD e-Series funds

DIY CANADIAN HOW-TO GUIDE: Buying TD e-Series funds

- Login to 'WebBroker' with your 'ConnectID' and password.

- If you have followed the steps to open your TD Direct Investing Account (aka TD Waterhouse account) as I recommended, you should now be able to login to WebBroker by clicking on this link.

- Click 'Buy/Sell' and buy the desired 'Mutual Fund'

- Click the 'Buy/Sell' button (pictured to the right) and then click on the 'Mutual Fund' tab. Even though TD e-series funds are index funds, they are still a form of mutual fund (without the high fees) and are listed as 'Mutual Funds' so you have to click the 'Mutual Fund' tab at the top of the page (pictured below)

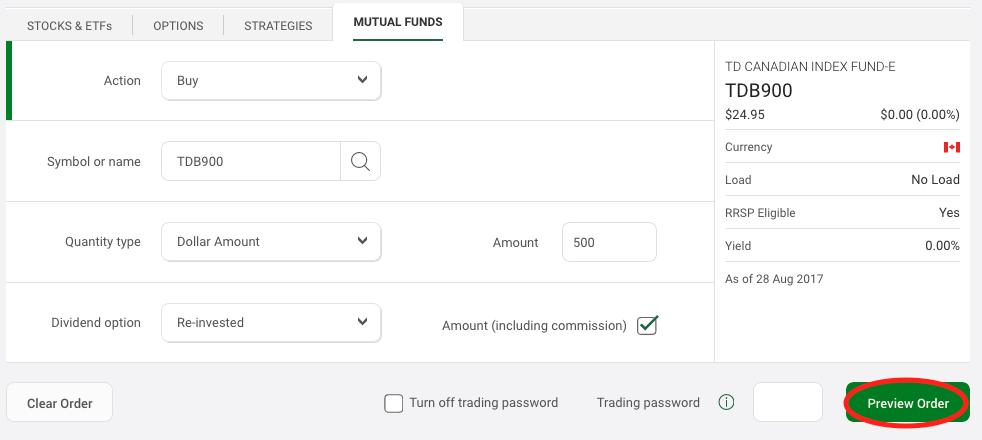

- Type in the fund 'symbol' that you wish to buy/sell. For example, the TD e-series Canadian index fund is listed as 'TDB900'. Please check this page to determine which funds I recommend that you buy and the allocation of each.

- I recommend that you type in a 'Dollar Amount' instead of the number of 'Units' since TD e-series is able to buy/sell fractional units at no extra charge (so there is really no reason not to do this!).

- For buying: For the 'Dividend Option' leave it as 'Re-invested' and check off 'Amount including commission'. If you have done everything correctly, your order should look like the one in step 3 (although the dollar amount may be different than the $500 I used).

- After typing in your trading password (if enabled), click 'Preview Order' (circled in red in the picture below), sign the agreement and place your order

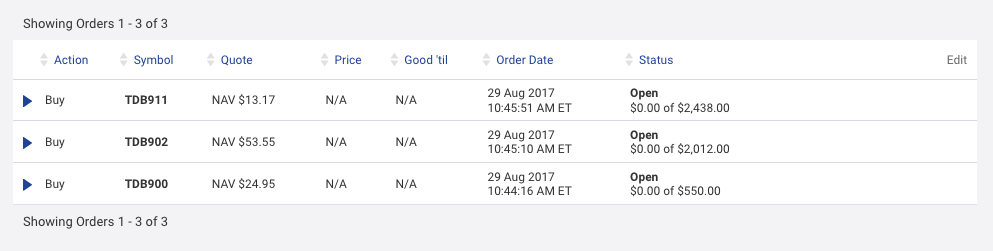

- Check your 'Order Status'

- Once you have placed your order, you can check to make sure that you orders have been placed by clicking the 'Order Status' button (pictured to the right) at the top of the WebBroker page

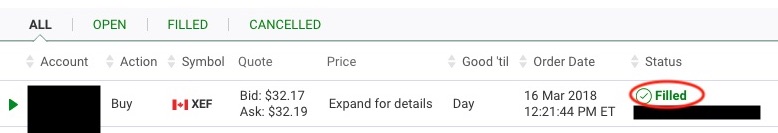

- If you do not see your order listed (like my 3 TD e-series buy orders in the picture below) then you did not correctly place the order. If your order is listed as 'Open' that means that your order has been placed. It will become 'Filled' (no longer 'Open') depending on when you placed the order as mentioned earlier on this page. *If you order your TD e-series funds before 3 pm, then you will get that day's 'end of day' price and your order should be 'Filled' at the end of the day. If you order the TD e-series funds after 3 pm, then you will get the 'end of day' price for the next business day and your order should be 'Filled' during the next business day.

- In my experience, if you place the order before 3 pm, it will not show as filled until the next business day as there is a bit of a delay in processing the information. Once the order is listed as filled, there is also a delay in updating your cash balance.

Q: Am I able to sell my TD e-Series funds, then use the cash from the sale to buy ETFs all in the same business day?

Great question! Unfortunately, the answer is no. If you place your order to sell during market hours (which starts at 9:30 am in Canada and the U.S.) and before 3 pm, your order will get the end of day price for that business day BUT it won't be 'filled' until between midnight and 9 am of the next business day. This means you won't be able to purchase ETFs until the next business day. If you wait until after 3 pm to place your order to sell, then you won't have your order filled until 2 business days later.

You can check if your order has been 'filled' by clicking on the 'Order Status' button at the top of your WebBroker Account page. Once your order is listed as 'filled' (shown circled in red in the picture below), the cash that you should receive as a result of the order will be available to be used immediately at this point. However, your cash balance will not be updated until around 10:30 am (check 'Real-Time Cash' on your Account Balances page for the most up-to-date information), but there is not need to wait until then. Just make sure your order is filled before buying ETFs!

Comments - Ask questions and/or provide feedback below!

*you can comment as a guest without registering/signing in by clicking on the 'Name' box below and checking the 'I'd rather post as a guest' box. If you don't feel comfortable providing your own email, you can just make one up (e.g. fakeemail@gmail.com).

DIY Canadian: How-To Guides for Canadians

DIY Canadian: How-To Guides for Canadians