Q: What is 'Norbert's gambit' and why are we talking about it?

to CAD (Canadian) with Norbert's Gambit.jpg) Norbert's gambit is a term used to describe a method of converting Canadian money into U.S. dollars (or the other way around) through a discount brokerage by buying an 'interlisted stock/ETF' (means listed on multiple stock exchanges) or an ETF/stock that can be held in different currencies on the same exchange. First, one would buy the stock/ETF in the currency he wants to change (e.g. Canadian money) and then selling it in the currency he wants to acquire (e.g. U.S. money). Generally this process takes a few days as one must wait for the stock to be 'journalled' over to the exchange that you want to sell on. For example, if I bought an interlisted stock at Questrade on the Toronto Stock Exchange (TSX) in Canadian dollars, I would have to call a Questrade customer service representative to 'journal' (move) the stock over to the New York Stock Exchange (NYSE) to sell in U.S. dollars.

Norbert's gambit is a term used to describe a method of converting Canadian money into U.S. dollars (or the other way around) through a discount brokerage by buying an 'interlisted stock/ETF' (means listed on multiple stock exchanges) or an ETF/stock that can be held in different currencies on the same exchange. First, one would buy the stock/ETF in the currency he wants to change (e.g. Canadian money) and then selling it in the currency he wants to acquire (e.g. U.S. money). Generally this process takes a few days as one must wait for the stock to be 'journalled' over to the exchange that you want to sell on. For example, if I bought an interlisted stock at Questrade on the Toronto Stock Exchange (TSX) in Canadian dollars, I would have to call a Questrade customer service representative to 'journal' (move) the stock over to the New York Stock Exchange (NYSE) to sell in U.S. dollars.

*Note: Norbert's Gambit will only work if you can hold U.S. dollars in your account. There are a few brokerages that don't allow this to happen in their RRSPs.

The reason we are talking about this is because it is thought to be the least expensive way of converting money by avoiding banking/brokerage fees for making this exchange directly through them. Banks/brokerages typically charge greater than 1% on currency conversions, which means that if you are investing $10,000 then you will be charged at least a $100 service fee for the exchange. Questrade charges a 2% currency conversion fee, which would end up being a $200 fee on $10,000. You can see how this starts to add up! Norbert's gambit is a perfectly LEGAL way of avoiding these additional currency conversion charges.

Using Norbert's gambit, you can avoid this service charge and will end up only paying the insignificant ECN (electronic communication networks) fees and the standard commission for selling an ETF/stock. ECN fees are in the magnitude of 0.001-0.004 cents/share, so you shouldn't really be concerned with this. The commission for selling an ETF/stock at Questrade is 1 cent/share with a $4.95 minimum charge and up to a $9.95 maximum charge for commission. It is commission-free to purchase ETFs at Questrade and costs 1 cent/share to buy stocks (again, with the $4.95 minimum charge and up to the $9.95 maximum charge). You should be charged no more than $20 in fees on $10,000 using Norbert's Gambit, which ends up saving you hundreds of dollars by avoiding the brokerage's currency conversion fees. Any way you look at it, Norbert's gambit will save you money and as the amount you are investing grows so does the savings using this technique.

Using Norbert's gambit, you can avoid this service charge and will end up only paying the insignificant ECN (electronic communication networks) fees and the standard commission for selling an ETF/stock. ECN fees are in the magnitude of 0.001-0.004 cents/share, so you shouldn't really be concerned with this. The commission for selling an ETF/stock at Questrade is 1 cent/share with a $4.95 minimum charge and up to a $9.95 maximum charge for commission. It is commission-free to purchase ETFs at Questrade and costs 1 cent/share to buy stocks (again, with the $4.95 minimum charge and up to the $9.95 maximum charge). You should be charged no more than $20 in fees on $10,000 using Norbert's Gambit, which ends up saving you hundreds of dollars by avoiding the brokerage's currency conversion fees. Any way you look at it, Norbert's gambit will save you money and as the amount you are investing grows so does the savings using this technique.

Q: So when would YOU use Norbert's Gambit?

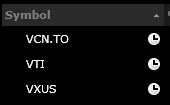

The only reason that I would need to use Norbert's Gambit is when I am investing in either the VTI (U.S.) or VXUS (international) ETFs through Questrade. The VTI and VXUS ETFs are held on the New York Stock Exchange (NYSE) and so must be traded in U.S. dollars, whereas VCN.TO and ZCN.TO are traded on the Toronto Stock Exchange (TSX) and so are traded in Canadian dollars. If you purchase the VTI and VXUS ETFs through your brokerage with only Canadian dollars in your account, the funds will be charged interest since you are technically 'borrowing' U.S. dollars from Questrade. You can request a currency conversion of Canadian dollars to U.S. dollars prior to purchasing on the NYSE but this will include a currency conversion fee of 2% of the funds that you are converting (e.g. $10,000 CAD converted into USD will include a $200 conversion charge!).

The only reason that I would need to use Norbert's Gambit is when I am investing in either the VTI (U.S.) or VXUS (international) ETFs through Questrade. The VTI and VXUS ETFs are held on the New York Stock Exchange (NYSE) and so must be traded in U.S. dollars, whereas VCN.TO and ZCN.TO are traded on the Toronto Stock Exchange (TSX) and so are traded in Canadian dollars. If you purchase the VTI and VXUS ETFs through your brokerage with only Canadian dollars in your account, the funds will be charged interest since you are technically 'borrowing' U.S. dollars from Questrade. You can request a currency conversion of Canadian dollars to U.S. dollars prior to purchasing on the NYSE but this will include a currency conversion fee of 2% of the funds that you are converting (e.g. $10,000 CAD converted into USD will include a $200 conversion charge!).

*Note: that this does not apply to the TD e-series funds. The e-series funds are held in Canadian dollars and there is no need to convert your money into U.S. dollars.

Q: Who in the world is Norbert? And what is this gambit you speak of?

Very valid questions. Apparently Norbert Schlenker first introduced the technique on 'the Wealthy Boomer' forum, hence the Norbert part of the name. A gambit in chess is when a player makes a sacrifice (usually a pawn) to achieve some sort of advantage that will be better for that player in the end. So in this case the sacrifice is buying an ETF using Canadian dollars, 'journalling' it over (don't worry we'll get to this term) and then selling the ETF in U.S. dollars. So what's the sacrifice? Well, there's the commission charge for selling the ETF and there is a risk of market fluctuations that could lead to losses between the time you buy and then sell the ETF. That is an extremely small sacrifice to pay (e.g. like losing a pawn in chess) for the end reward (e.g. setting yourself up for the checkmate) of saving yourself hundreds of dollars in currency conversion charges.

Q: Sounds too good to be true... What are the risks?

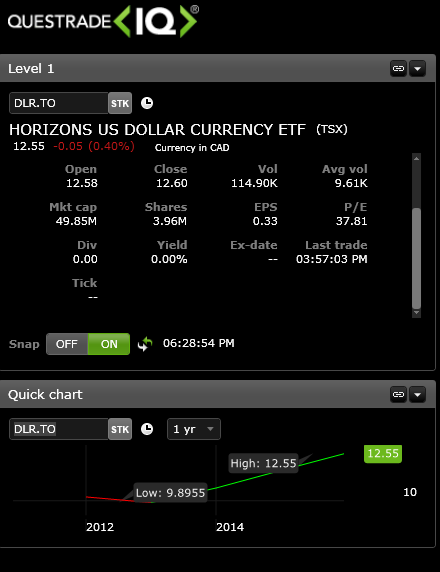

The risks are ALMOST not worth mentioning. However, I should probably mention that like any stock/ETF there is the potential for the stock/ETF to lose market value while the shares are being 'journaled' from one currency to another. This is balanced out by the equal (and maybe slightly better) chance that the stock/ETF could gain market value during the journaling time and therefore you could make an additional profit. For example, the 'Horizons U.S. Dollar Currency ETF' (DLR.TO and DLR.U.TO) will reflect the price (in Canadian dollars) of the U.S. dollar. If the U.S. dollar increases in value in comparison to the Canadian dollar, then the value of DLR.TO will increase. If 1 CAD = 0.9 USD, then DLR.TO might be trading at $10 CAD per unit, while DLR.U.TO might be trading at $9 USD per unit. Essentially, as soon as you buy units of DLR.TO, the value is converted to U.S. dollars and the price can fluctuate as the U.S. dollar goes.

The risks are ALMOST not worth mentioning. However, I should probably mention that like any stock/ETF there is the potential for the stock/ETF to lose market value while the shares are being 'journaled' from one currency to another. This is balanced out by the equal (and maybe slightly better) chance that the stock/ETF could gain market value during the journaling time and therefore you could make an additional profit. For example, the 'Horizons U.S. Dollar Currency ETF' (DLR.TO and DLR.U.TO) will reflect the price (in Canadian dollars) of the U.S. dollar. If the U.S. dollar increases in value in comparison to the Canadian dollar, then the value of DLR.TO will increase. If 1 CAD = 0.9 USD, then DLR.TO might be trading at $10 CAD per unit, while DLR.U.TO might be trading at $9 USD per unit. Essentially, as soon as you buy units of DLR.TO, the value is converted to U.S. dollars and the price can fluctuate as the U.S. dollar goes.

DLR.TO is the ETF that will be used in the examples to follow as it generally does not 'move' (lose/gain in market value) as much as a stock and so is a bit safer to trade as long as you journal the units over to DLR.U.TO immediately after purchasing. If DLR.TO does increase in price after you have purchased shares and had them journalled over, then that is a good thing for you. This means that if you had waited to buy DLR.TO at the increased price, then you would not have been able to buy as many units (that are then journalled over to DLR.U.TO for the same number of units) and therefore, would not be able to sell as many units of DLR.U.TO to get US dollars.

The other risk is that the volume of DLR.TO and DLR.U.TO units that are bought and sold are relatively low. This means that the buy-sell spread can often be in the 0.02 range, but in the end that is only 0.2%. Remember that buying/selling stocks and ETFs is a negotiation process between the buyer and seller. This is why setting limit orders at fair prices and waiting for them to be filled at that price is important.

Q: Alright, I'm sold. So now that I want to buy an ETF in U.S. dollars, what are the exact steps I need to take? Remember I'm a newbie!

Ok, here we go. Consider this Norbert's Gambit for dummies...

OFFICIAL ![]() DIY CANADIAN HOW-TO GUIDE: Converting money from CAD to USD using Norbert's Gambit

DIY CANADIAN HOW-TO GUIDE: Converting money from CAD to USD using Norbert's Gambit

- Ensure that you have the necessary funds that you want to convert in your discount brokerage account.

- Get a quote (# of units that can be purchased) for an 'interlisted stock/ETF' in the amount of Canadian dollars you want to spend (e.g. if the price of one unit of DLR.TO is $12.60 then you could buy a maximum of 793 units with $10,000). The most commonly used interlisted stock/ETF for Norbert's Gambit is the 'Horizons U.S. Dollar Currency ETF'. It is listed as DLR.TO (CAD) and DLR.U.TO (USD). So if we were starting with CAD, then we would buy as many units of DLR.TO as possible with the funds you want to convert to USD. This is what we will use in this example.

- Buy units of DLR.TO. At Questrade, it is free to buy ETFs. Use a buy 'limit order' (as opposed to a market order)

to avoid additional ECN fees. For a quick transaction, you can set your buy limit order at the current ask price so that the order is executed (goes through) right away. However, this will lead to additional ECN (Electronic Communication Network) fees. Although the fees will be small ($0.0035/unit), you can avoid this by setting your buy limit order below the current ask price. This may require you to wait longer (especially since this ETF has a fairly low trade volume) for your order to execute and you may have to modify the order if the market moves in the opposite direction of what you set your limit order price as. I prefer to do a buy limit order slightly below the ask price to avoid the ECN fees, but I have on many occasions decided to 'bite the bullet' and set my buy limit order at the ask price to avoid having to wait (since it could take you a couple of days to get your price otherwise). At $0.0035/unit, this works out to a fee of $3.50 for every thousand shares (which is worth approx. $12,150 at a unit price of 12.15). That is a small fee to pay if you are on a tight schedule.

to avoid additional ECN fees. For a quick transaction, you can set your buy limit order at the current ask price so that the order is executed (goes through) right away. However, this will lead to additional ECN (Electronic Communication Network) fees. Although the fees will be small ($0.0035/unit), you can avoid this by setting your buy limit order below the current ask price. This may require you to wait longer (especially since this ETF has a fairly low trade volume) for your order to execute and you may have to modify the order if the market moves in the opposite direction of what you set your limit order price as. I prefer to do a buy limit order slightly below the ask price to avoid the ECN fees, but I have on many occasions decided to 'bite the bullet' and set my buy limit order at the ask price to avoid having to wait (since it could take you a couple of days to get your price otherwise). At $0.0035/unit, this works out to a fee of $3.50 for every thousand shares (which is worth approx. $12,150 at a unit price of 12.15). That is a small fee to pay if you are on a tight schedule.

Wait, why do I have to pay extra for placing my buy limit order at the ask price?

The reason for this is because you are taking liquidity out of the market (aka reducing liquidity) when your order is executed immediately (which will happen when buying with a limit order at the current ask price). One way to think of liquidity is that if you are reducing the amount of orders the exchange has then you are reducing liquidity, whereas you are adding liquidity if you are increasing the number of orders the exchange has. The amount you will pay for a commission will not change. These same fees will be charged in as well as doing a limit order at the current bid price when selling)

- Contact a Questrade customer service representative through live chat (my preferred choice), email, or phone immediately after buying the DLR.TO units (or contact them via live chat or email) and ask them to 'journal' over the DLR.TO to DLR.U.TO. See the chat log below if you are wondering what you should say the the Questrade customer service rep to get the 'journaling' process started. You can journal right after buying DLR.TO, but this journaling process won't happen until the buy settles at the exchange. This is a standard wait for purchasing securities such as ETFs and stocks and takes 2 business days as of September 5, 2017 (it used to be 3 business days prior this). Once the buy settles, the 'journaling' process usually takes 1-2 business days. So in total it will usually take 3-4 business days. *I prefer live chat so that I have a record of the conversation in case there are any issues (though this hasn't occurred yet!). You will know that it has been completed when you see that you have units of DLR.U.TO in your account instead of DLR.TO. You will receive the exact same number of units of DLR.U.TO as you have of DLR.TO at the time you requested the journalling (the journalling request is for the quantity, not the value, of the shares). This means that the price flutuations of DLR.TO after putting in your request to journal them over to DLR.U.TO will not affect the amount of US dollars you will end up with (*although you could consider it a gain if the price of DLR.TO goes up after you bought shares and made the request to journal them since you would have been able to buy a lower quantity of shares had you waited).

*Please note that anything that is in brackets, italicized and starred in the chat log below are my own comments that were not included in the actual chat with the Questrade rep.

- Questrade Rep: Thanks for contacting Questrade. How can I help you?

- Me: Hi there, I was hoping to get you to journal my DLR.TO units to DLR.U.TO units. All of the DLR.TO units were purchased today.

- Questrade Rep: I can definitely assist you with this. Before we continue, if you can kindly, verify your username, email address and confirm if there were any deposits in the last 30 days. (*I will not include my response to these questions to maintain my privacy and account security*)

- Questrade Rep: Perfect, thank you for your verification. Given that the shares were bought today, it will take 2 days to settle and then the journal will take 1-2 business days. So it will be done roughly by March 21. I will go ahead and make a request for the 1000 shares now. So that once it settles we will begin the process to journal. (*To give you some perspective, I made this request on March 15. I would always make sure to have the Questrade rep give you a rough idea of when the DLR.TO units will be journaled over to DLR.U.TO units and make sure they mention the exact # of units be journaled, which in this case is 1000)

- Me: Ok great. Thank you. And just to make sure, there are no fees for this right?

- Questrade Rep: There are no fees to journal.

- Me: Ok great. Thanks

- Questrade Rep: Allow me a moment to provide your with the confirmation number. (*make sure they give this to you; ask for it if you have to!*)

- Me: Perfect. Thank you

- Questrade Rep: Your confirmation is 12345678

-

Make sure that in your account settings, you have the option "currency of transaction" checked off (which it should be by default, but still a good idea to check) to ensure your discount brokerage doesn't automatically convert the money back to CAD upon selling the DLR.U.TO. At Questrade, this setting can be found on the 'Account Management' page (in myQuestrade, under My Accounts). This step is not required for non-registered accounts (aka Margin accounts) at Questrade since the currency settlement is "currency of transaction" by default.

-

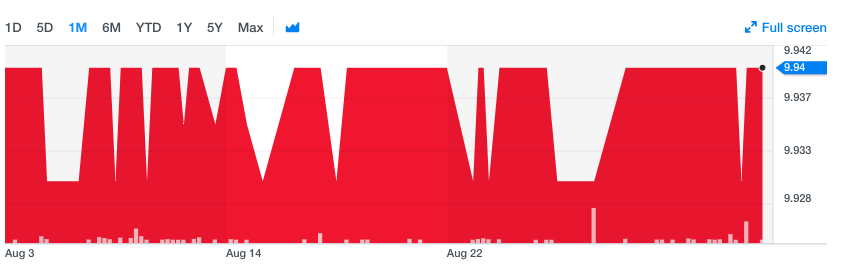

Sell DLR.U.TO. Selling ETFs at Questrade costs a maximum of $9.95 CAD commission per trade (+ ECN fees). The commission will end up being paid using US dollars as a part of the sale of DLR.U.TO ($4.95 USD + ECN fees; the last time I did Norbert's Gambit in 2018, I was charged just over $15 as a 'commission' which included the ECN fees). Use an ask 'limit order' (as opposed to a market order) to avoid additional ECN fees. This is the step where it can pay off to be patient. Units of DLR.U.TO rarely fluctuate in price (like DLR.TO does) and generally remains constant so it is very predictable as to what the bid and ask prices will be. This is because DLR.TO reflects the changes in the exchange rate between CAD and USD, while DLR.U.TO is what DLR.TO is weighed against so it doesn't change (e.g. for 1USD = 1.(XX) CDN, you'll see the USD remains constant at 1). I use Yahoo Finance to check out any trends in this ETF (here is the link to DLR-U.TO at Yahoo Finance). For example, if you look at the last month (August 2017) in which DLR-U.TO was traded (check the graph below from Yahoo Finance which also allows you to see the volume of trades), you will notice that the highest that DLR.U.TO units have been traded at is 9.94 and the lowest it has been traded at is 9.93. I do NOT recommend immediately setting your ask limit order at the current bid price in order to make a quick sale. If you are willing to be patient, you will most likely sell at the higher price (9.94) based on the data from Yahoo Finance so set your limit order at that price. However, this could take several days (and sometimes even a week or more) so you will have to place your order more than once. It is an especially good idea to be patient when selling a large amount of DLR.U.TO. If you are selling 1000 units of DLR.U.TO, then there is a 10 dollar difference between selling at 9.93 per unit ($9930) and 9.94 per unit ($9940). For every 1000 additional units you sell on top of this, it is an additional $10 difference between the two prices. This would be on top of the additional ECN fees ($0.004/unit) that you would incur for reducing liquidity by placing your ask limit order at the current bid price. So in the end, some people (myself included) will take a $10-20 hit (for 1000-2000 units) in order to sell quicker, rather than have to potentially wait multiple days to get the best possible price. If I was selling 10,000+ units then I would be more willing to be patient ($100+ difference).

-

You now have U.S. dollars in your account that you can use to buy stocks/ETFs that are listed on the NYSE, NASDAQ, etc. in USD. You can buy ETFs/stocks with the US dollars immediately after selling DLR.U (the DLR.U sale will technically settle on the trade date + 2 business days, but the purchase of VTI will also settle on the trade date + 2 business days so there's no need to worry about paying any interest)

*if you wanted to convert from USD to CAD, the only difference would be that you would be buying DLR.U.TO to start (instead of DLR.TO in Step 2), then journaling the units over to DLR.TO (instead of DLR.U.TO in Step 3) and eventually selling DLR.TO to end up with CAD.

Q: OK, I did it! Will this work with converting CAD to non-U.S. currencies?

It is possible, but doesn't work quite as well since other countries charge high brokerage fees that end up taking away any advantage gained by Norbert's Gambit.

Comments - Ask questions and/or provide feedback below!

*you can comment as a guest without registering/signing in by clicking on the 'Name' box below and checking the 'I'd rather post as a guest' box. If you don't feel comfortable providing your own email, you can just make one up (e.g. fakeemail@gmail.com).

DIY Canadian: How-To Guides for Canadians

DIY Canadian: How-To Guides for Canadians