*Note: the information below has been updated for 2018 (last update: March 2018)

Do you want to make your money work for you without having to pay ridiculous management fees to banks and financial advisors?

I believe in passive investing that does not require you to constantly study the markets in order to make money. It has been proven that trying to time the markets is a losing game. My approach focuses on careful planning with regards to the initial set up of investments and then letting the power of automatic monthly contributions, dollar cost averaging and index investing do the rest. Once the initial set up is complete, this is a very hands-off approach to investing that actually works!

Canada's mutual funds have some of the highest management fees in the world. The only explanation for it is that "Canadian fees are so high because investors don't seem to care". Some countries have regulations and laws that protect investor rights that includes maintaining reasonable mutual fund management fees. Unfortunately, Canada is not one of them and big banks/financial advisors have been robbing Canadians of their money for decades. The solution is to buy index funds and ETFs (Exchange Traded Funds) that track common stock indices with low fees. For example, S&P/TSX Composite is the main stock index in Canada and contains stocks of the largest companies on the Toronto Stock Exchange (TSX). XIC.TO is an ETF that you would purchase through the Toronto Stock Exchange to track the S&P/TSX Composite, which essentially means that you would own shares of all companies that exist in the S&P/TSX Composite. If the Canadian stock market goes up, you make money!

Over the years, it has been shown that the stock market fluctuates rapidly but that it will always outpace inflation in the long-run. If you keep your money in index funds for multiple years, not only are you guaranteed to make money, but you will also beat the majority of financial advisors who claim to know how to 'time the market'. If people actually knew how to 'time the market' by selling at market peaks and buying at market lows then everybody who invested in the stock market would be rich. There needs to be winners and losers in every game and the stock market is no different. Index funds and ETFs don't try to beat the market, but instead just try to keep pace with the inevitable long-term gains. Index funds and ETFs have the huge benefit of charging the lowest possible management fees so that you get to keep all of the profits rather than having to fork it over to a financial advisor.

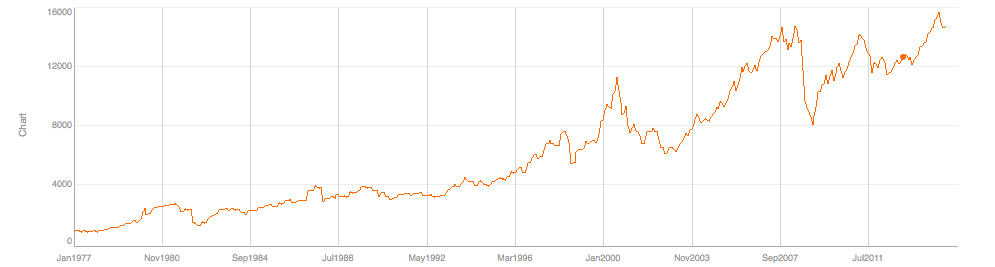

The graph below illustrates the performance of the S&P/TSX Composite since 1977. As you can see, there have been many peformance peaks and valleys over the years which investors call bull markets (periods leading to peaks) and bear markets (periods leading to valleys). The important thing to note here is that there is a significant upward trend. The graph shows that if you put your money into the stock market and just sit back without worrying about it for a few years, your money will grow and outpace inflation. If you had invested money into the stock market in 1977 so that it tracks the S&P/TSX Composite (e.g. an index fund), your money would have grown by more than 1500%! And this doesn't even factor in the beauty of compound interest ("interest on interest") that will be discussed later. That means that if you had invested $10,000 dollars into the an S&P/TSX Composite index fund in 1977 and left it at the mercy of the markets, that money would now be worth more than $150,000.

Q: So what is this 'automatic monthly contribution' you speak of and how do I set it up?

The most effortless and least stressful way to invest your money is to make it automatic. This can be done with both registered (e.g. TFSA, RRSP) and non-registered investment accounts but often follow a different procedure (e.g. have to fill out different forms). The process may differ slightly between banks/brokerages but in general it should be a relatively similar and easy process. This would be done AFTER you have opened your investment account with your chosen bank/brokerage (e.g. TD Direct Investing Account).

My recommendation is that you set up a Monthly Contribution Plan (MCP) with TD Direct Investing (formerly TD Waterhouse) as it is quick and easy. You could have money automatically deposited into a registered savings plan (RRSP or TFSA) at TD Direct Investing directly from your regular chequings/savings bank account.

Once your MCP is set up you will want to create a Systematic Investment Plan (SIP) and Dividend Reinvestment Plan (DRIP) so that your money is automatically invested once it arrives in your investment account and dividends are automatically reinvested. After you've done this, sit back, relax and watch the money pile up! But in all seriousness, you should check in periodically to ensure that your MCP and SIP are running smoothly and to possibly 'rebalance' your investment portfolio to stick to your original allocations (% of portfolio). Here is a guide for setting everything up:

- Open a TD Direct Investing Account

- See the How-To guide on how to open a TD Direct Investing account by clicking here.

- Download, complete and mail the Self-directed RSP Monthly Contribution Plan Authorization Form along with a void cheque (for chequings accounts) OR bank statement, direct deposit form and signed/stamped account info (for savings accounts).

- The MCP Authorization Form for TD Direct Investing can be found at this link, and going to the 'Automatic Investment Plans' plan tab on that webpage. The form should be mailed to TD Waterhouse Cash Management Department, 77 Bloor St. West, 7th Floor, Toronto, Ontario, M5S 1M2

- Indicate the amount of each contribution and which day of each month (e.g the 1st day of every month) you wish the money to be contributed. You can also indicate which month you would like this to begin if you didn't want to do it right away. Keep in mind that bank to bank transactions can often take a few days to process so if you want the money to be available on the 1st of each month then you should probably have it sent a few days before.

- IMPORTANT: The form states that you should include a 'void cheque' if your bank account is not with TD. This would not be a problem with a chequings account, but will likely not be possible if you want your money to come out of a savings accout. However, you can set up automatic withdrawals from a savings account if you provide the appropriate information to you bank/brokerage that you want to invest your money with. Call to find out what they need! For example, TD Direct Investing was able to create a monthly contribution plan for me with the money coming out of my PC Financial Interest Plus Savings Account after I provided them with a bank statement and direct deposit form (obtained through your PC Financial online account under 'moving money' and clicking 'set up direct deposits'). I could have also sent a signed/stamped copy of my savings account info (had to call PCF to have this sent) if TD felt that this wasn't enough information, but it wasn't necessary in my case. These documents should include your bank code, transit number, branch name, account number and your name. TD has stated that "you have the option of sending this through without a void cheques, however if you do, please make sure that you have all your account information correctly inputted on the form to avoid delays in processing". It takes a bit more effort, but in the end I believe it is worthwhile since your money can accumulate interest in your savings account before it is withdrawn to your investment account.

- For non-registered accounts (aka cash accounts) at TD, you will need to fill out a Pre-Authorized Deposit Form instead of the MCP Authorization Form. You can find this form here.

- If you only want to add one large lump sum or if you want to add an additional contribution to your investment account, you can Also, depending set up your investment account (e.g. TD Direct Investing account) as a bill payment which will allow you to 'transfer' funds from the other institution to your investment account.

- There are no fees for setting up a MCP!

- There are no minimum amounts of money that must be transferred each month in order to set up a MCP. If you wanted, you could create a $5 MCP. Some savings is always better than no savings!

- Just because your money is going into a registered savings plan or an investment account does NOT mean that it is being invested. You will have to do some research to determine what you want to invest in. I have set up a MCP to TD Direct Investing and created a SIP (which is discussed next) for the TD e-series index funds.

- Once you have set up your MCP, it's time to create a Systematic Investment Plan (SIP) so that your money is automatically invested. For TD Direct Investing Accounts, you must call to speak to an investment representative and have him/her set up the SIP. You can NOT do this online. You can also set up a Dividend Reinvestment Plan (DRIP) at this time.

- If you are with TD Direct Investing, call 1-800-465-5463 or 416-982-7686

- Inform the investment representative of how the money from your MCP is going to be allocated. For example, I have 35% of my monthly contribution invested in the Canadian e-series index fund, 35% in the U.S. e-series index fund, and the other 30% in the International e-series index fund. You can learn more about my strategy here.

- Note that the date that you set your SIP up for will actually be reflected in your account 2 business days later. This is because the trade settlement date (when the funds are actually fully purchased) will be the trade date + 2 business days. So you can set your SIP up for the same day as your MCP but the TD e-series funds won't be fully purchased (and show up in your account) until 2 business days later. It is NOT recommended that you set your SIP up before your MCP so the best plan is to have them scheduled to occur on the same day.

- IMPORTANT: Make sure that the investment representative also knows that you want to automatically reinvest any dividends that you earn from your e-series index funds. This is called a Dividend Reinvestment Plan (DRIP) which "allows you to purchase additional shares or mutual fund units automatically from the cash dividends paid on eligible securities, without incurring commission costs"

- There are no fees for setting up a SIP or DRIP! However, keep in mind that some brokerages charge commissions for buying certain investments (e.g. stocks, ETFs, etc.). You don't have to worry about these charges with TD e-series funds which is why I use a SIP and DRIP.

- WARNING: The minimum amount you can invest in any one TD e-series fund using your SIP is $25. If you aren't using a SIP to invest your money and are buying it through your WebBroker account (TD Direct Investing's online trading platform) then you must invest a minimum of $100 for each e-series fund.

- Check your investments periodically to ensure that your MCP and SIP are running the way you want them to (sometimes mistakes are made!) and rebalance your account every 3-6 months.

- It is a good idea to 'rebalance' your investment portfolio to stick to your original allocations. Your allocations are the percentage of the portfoilio that is apportioned to each specific investment and should have been determined prior to beginning a SIP.

- For example, I try to stick to a portfolio that includes 35% Canadian e-series index fund, 35% U.S. e-series index fund, and 30% in the International e-series index fund. If the U.S. index fund does well then it will become a bigger part of your investment portfolio then you may have originally wanted it to be (e.g. from original 35% to 37%) so you would sell off some units and add them to index funds/investments that did not do as well (e.g. Canadian e-series index may have dropped from 35% to 33% of your portfolio) to bring your investment portfolio back in 'balance'.

- At TD Directing Investing, you will need to do this on your own by logging into your account.

- IMPORTANT: TD e-series index funds have 30 day 'holding periods'. This means that if you sell units of a TD e-series index fund that you purchased within the last 30 days, you will be charged an additional fee (2% early redemption fee). Any units that have been held for longer than 30 days are free to sell. Keep in mind that it USED to be 90 day holding periods, so if you see this information on a website then it is outdated.

Q: What if I want to change my Monthly Contribution Plan (MCP) or Systematic Investment Plan (SIP)? How would I do that?

The only way to change your MCP and/or SIP once you have set it up is to call TD Direct Investing and have a representative do this for you. The phone number to call for TD Direct Investing (General Investing Inquiries) is 1-800-465-5463. The TD rep. that you first speak to will be able to change your MCP, but they will need to transfer you to a 'TD trading rep' in order to change the SIP. You should always ask for the name of the people that you speak to on the phone and once each change has been made, ask for a reference number for the change (and write this information down somewhere). This information can be useful if there is an issue with the change.

Also, I always make sure to let the TD Direct Investing representative know that I would like dividends from my investments to be automatically reinvested through a DRIP (dividend reinvestment plan). They have told me that this should happen by default so it isn't necessary to actually state this (but you can never be too safe!).

Q: I like the convenience of buying TD e-series funds automatically through a Monthly Contribution Plan (MCP) and Systematic Investment Plan (SIP), but want to also enjoy the lower MER (aka fees) associated with buying ETFs and don't want to pay commissions for buying ETFs. Is it possible to have the best of both worlds?

Yes it is! There are two possible ways that I would convert from TD e-Series to ETFs (which I have described as Option 1 and Option 2 below).

Check out my RRSP, TFSA and non-registered webpages to see what kind of ETF portfolio I would recommend. It is important to keep in mind the MER (management expense ratio) of each ETF, but also to factor in foreign withholding taxes which can actually be much more than the MER (even though MER gets much more attention). A good starting point for learning about foreign withholding taxes is to check out this blog post by the Canadian Couch Potato (Dan Bortolotti) and downloading the 'newly revised white paper' from that webpage.

Option 1: Buy ETFs through TD Direct Investing

Sell your TD e-series funds (make sure you don't sell any units that have been purchased in the last 30 days to avoid additional fees) then buy ETFs at TD with the money from your TD e-series funds. This ensures that your TFSA is all in one account with TD. The downside is that TD charges a $9.99 commission for each ETF purchase. So for the 3 ETF portfolio that I use, I would be charged approx. $30 each time I decide to buy ETFs ($9.99 multiplied by 3). This is the more convenient option (less hassle) but is also a bit more expensive.

Sell your TD e-series funds (make sure you don't sell any units that have been purchased in the last 30 days to avoid additional fees) then buy ETFs at TD with the money from your TD e-series funds. This ensures that your TFSA is all in one account with TD. The downside is that TD charges a $9.99 commission for each ETF purchase. So for the 3 ETF portfolio that I use, I would be charged approx. $30 each time I decide to buy ETFs ($9.99 multiplied by 3). This is the more convenient option (less hassle) but is also a bit more expensive.

*Your results may vary, but you can negotiate with a TD Direct Investing representative to apply a credit for you for the $9.99 commissions on your future ETF purchases in order to keep your business at TD (you can use the threat to transfer to Questrade where there are no commissions for buying ETFs). Keep in mind that the first TD representative that you speak to will likely offer you 50% off of your ETF commissions at TD (so you would pay a 4.99 commission for each ETF purchase instead) and will be unable to give you a better deal. Ask for a manager and they will have the ability to give you a credit that will negate the entire commission of your ETF purchases. I have been able to get a $39.96 credit applied to my account prior to purchasing ETFs as I said that I will be buying 4 ETFs ($9.99 multiplied by 4 is $39.96). This ETF commission credit will NOT count as a TFSA contribution so you do not have to worry about this wasting some of your valuable contribution room. If you are able to successfully negotiate a commission rebate, then this option is by far the best choice. If not, consider option 2 below.

As an added benefit to keeping my TFSA at TD Direct Investing rather than Questrade, I will increase my investment portfolio diversification slightly. I already have money invested in a RRSP and a non-registered account at Questrade. Ensuring that not all of my investments are with one brokerage will provide additional safety (mainly as protection against the very remote chance that one of these brokerage's fails or goes bankrupt).

Option 2: Buy ETFs through Questrade (After a Transfer or Withdrawal from TD)

Sell your TD e-series funds (once again make sure you don't sell any units that have been purchased in the last 30 days to avoid additional fees) then open a TFSA account with Questrade.

Sell your TD e-series funds (once again make sure you don't sell any units that have been purchased in the last 30 days to avoid additional fees) then open a TFSA account with Questrade.

Transfer the money from the sale of your TD e-series funds to Questrade. The reason that I have bolded the word transfer is because if you transfer your money from one brokerage to another, then it will not appear as a withdrawal from your TFSA. This will allow you to buy ETFs immediately once the money appears in your account at Questrade. If you withdraw money from your TFSA at TD and then deposit it into your account at Questrade, the Canadian government will view that as an overcontribution to your TFSA and you will incur a penalty tax on that overcontribution (assuming you went over the maximum allowable room in your TFSA).

Questrade will reimburse the transfer fee (up to $150) that TD will charge you for transferring investments or money in an account over to Questrade IF the account being transferred is worth $25,000 or more. This fee will be $135 + tax. Questrade will only reimburse the transfer fee once per client and this reimbursement could be used on any account (e.g. TFSA, RRSP, non-registered account). You can transfer all or part of of your account at another financial institution (TD Direct Investing in this case) to Questrade. You can transfer the account 'full in-cash' (all funds in cash), 'full in-kind' (all assets i.e. cash and securities), 'partial in-cash' (portion of funds in account in cash) OR 'partial in-kind' (portion of assets i.e. cash and securities). 'In-kind' means the securities (e.g. ETFs, mutual funds, etc.) would be transferred without a sale. This can only be done if both the sending and receiving brokerage allow the same security to be held in their investment accounts.

For a non-registered account, transferring in-kind can be useful (depending on the investments that you hold in your account) since it could allow you to avoid a capital gains tax. This will be the case if the receiving brokerage (Questrade) offers the same investments as the sending brokerage (TD Direct Investing). For example, both brokerages would offer all of the same ETFs and so if you hold ETFs in a non-registered account at TD, you could transfer them to Questrade without having to sell them (and therefore, incurring a capital gains tax).

*Keep in mind that if you hold the TD e-Series funds in a non-registered account (meaning accounts that are not a TFSA, RRSP or RESP) and you have unreazlied capital gains (meaning you have never sold the funds but they have gone up in value) on those funds, then the only way to move the value of these funds into ETFs is to sell the TD e-Series funds to get cash and then use the cash to buy ETFs. Unfortunately, this will lead to a capital gains tax for the tax year that you sell them in since you have sold the funds and made a profit. Half (50%) of the capital gains on the sale of your TD e-Series funds will be taxed at your marginal tax rate (e.g. 32% if you are making $80,000 in Ontario), while you will not have to worry about taxes on the other 50% (effectively meaning that you paid a 16% tax on your capital gains). You will have to keep your tax rate in mind if/when you decide to sell your TD e-Series funds and move to ETFs in a non-registered account. For example, it might be better for your taxes to sell some your TD e-Series funds this tax year (and ideally look for an investment that could be sold for a capital loss to negate the gain) and do this again for the next year. If you sell everything in one tax year then all of the capital gains will be occur in the same tax year which will increase your income and move you up to a higher tax bracket. This means more taxes and who wants that! So it may be beneficial to sell investments off slowly over the course of a few years to offset any losses/gains. This is not something you need to concern yourself with if the money is in a TFSA (as there will be no capital gains tax when you sell investments in a TFSA).

To do a direct transfer of your accounts between TD Direct Investing and Questrade, you could use the “Broker to Broker” transfer option in the funding menu. You can find this by logging into myQuestrade under 'Funding' and then clicking on 'Transfer account to Questrade'. Next, you would have to fill out that transfer form and upload the form to initiate the transfer. Once this is uploaded (to upload you can go to my.questrade.com, click on Account Management and then click on Upload document), Questrade will initiate the transfer process on your behalf. This process can take 10-20 business days to complete.

Once you have exhausted your one time reimbursement on the transfer fee, it will not make sense for you to continue doing transfers in the future (since the fee is so high at $135 + tax) unless it is a non-registered account OR RRSP and doing a withdrawal/deposit would incur a very large capital gains tax. However, that doesn't mean you can't move your money from one brokerage account to another. You will have to do it through a withdrawal/deposit to avoid the transfer fee.

If you are at your maximum allowable TFSA contribution room when you make a withdrawal from your TFSA, that money cannot be put into another TFSA account (or even put back into the same TFSA account) in the same year as it will appear (to the Canadian government) as an overcontribution to your TFSA. You must wait until next year to avoid penalties associated with overcontributing to a TFSA (as the withdrawal becomes contribution room for the next year). The ideal time to make a withdrawal from your TFSA (e.g. at TD) would be at the end of December and then you could deposit the money into another TFSA account (e.g. at Questrade) without incurring any penalties.

Comments - Ask questions and/or provide feedback below!

*you can comment as a guest without registering/signing in by clicking on the 'Name' box below and checking the 'I'd rather post as a guest' box. If you don't feel comfortable providing your own email, you can just make one up (e.g. fakeemail@gmail.com).

DIY Canadian: How-To Guides for Canadians

DIY Canadian: How-To Guides for Canadians