*Note: the information below has been updated for 2018 (last update: March 2018)

TD e-Series index funds are in my opinion the best way for beginners to passively invest. When starting out, it is best to hold these TD e-Series funds in a TFSA (as opposed to a RRSP or non-registered account) since it allows you to fully take advantage of the SIP and MCP as well as being easier to convert to ETFs (Exchange Traded Funds) at a different brokerage if you decide to do so down the road (due to withdrawals being allowed without consequence which is not the case for RRSPs). Once you gain experience investing and have a large sum of money to invest (rule of thumb used to be at least $50,000 but smaller amounts make more sense now that Questrade offers free ETF purchases), the move toward ETFs (Exchange Traded Funds) becomes a better option and in my opinion, is always the best option for a RRSP account. However, I love the flexibility of TD e-Series index funds (especially the convenience of setting up a SIP and MCP) for TFSA accounts and continue to keep them as part of my investment portfolio for my TFSA even though I have also purchased several ETFs.

TD Web Broker (through TD Direct Investing, which used to be called TD Waterhouse) is the platform that I use to buy and sell my TD e-Series investments. The picture below illustrates the heading that I see when I log into my account (with my name cut out).

I opened up a TD Direct Investing account to purchase my TD e-Series funds, although it is also possible to open it up through a regular TD Canada Trust account. TD Direct Investing is an investment brokerage, while TD Canada Trust is the regular bank (most likely what you think of when you hear TD). I highly recommend opening up a TD Direct Investing account as the people that you will be dealing with at the brokerage are much more knowledgeable about investments and the e-Series index funds. If you ever decide to add ETFs (click here to find out what they are) to your investment portfolio with TD, you will only be able to do this with a TD Direct Investing brokerage account (not possible with TD Canada Trust).

There have been some horror stories about TD Canada Trust workers who either are clueless about TD e-series index funds or don't want you to put your money into them (as they won't make a fat commission on them like they would for high fee mutual funds) and try to sell you something you don't need. The only scenario where it may make sense to open a TD Canada Trust account is if you want to open a RRSP and/or TFSA with less than $15,000 as TD Direct Investing will charge you a $25/quarter fee ($100/year). However, if you are new to investing and live in Canada then the first investment shelter you should utilize is the TFSA (Tax Free Savings Account). A non-registered account at TD Direct Investing is free if you have at least $15,000 in assets in ALL of your TD Direct Investing accounts combined OR you have enrolled in a SIP (sytematic investment plan) that is $100/month or more. Otherwise, you will pay a $25 quarterly fee. It is important to note that there used to be NO fees for opening a TFSA with TD Direct Investing (as long as you used e-statements), but this was changed in 2016. There are no brokerage commissions for buying/selling TD e-series index funds which makes them a great choice for a systematic investment plan using monthly or biweekly contributions. All it will take for you is one visit to a TD Direct Investing branch to set up your first account (which should be a TFSA if you still have contribution room) and then one more phone call to a TD Direct Investing rep if you want to set up a monthly contribution (which I highly recommend) to your TD e-series funds. You'll be done in 30 minutes.

Q: I have my TD Direct Investing account set-up, but how do I know which e-series index funds to invest in?

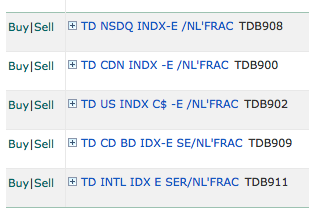

The e-series index funds that you should choose depend on your time horizon. Your time horizon is how long you are willing to leave your index funds untouched before you need to use the money in the funds (e.g. to buy a house, retirement). A general rule of thumb that can be used is 120 minus your age is the amount of equity (e.g. ETFs, stocks, mutual funds, TD e-Series funds) you should have in your portfolio. For example, if you are 27 years old, then 120-your age is 93% equity. The other percentage (7% for a 27 year old) should be invested in safer debt (non-equity) investments such as bonds, GICs, etc. I personally keep my non-equity money that I want to be readily accessible in a HISA (high interest savings account) with Simplii Financial since bond yields are historically low right now (due to low interest rates). I set up a monthly contribution from my HISA at Simplii Financial to my TD Direct Investing TFSA that is automatically invested through a SIP (systematic investment plan) into the TD e-series funds of my choice. In this way, I keep a portion of my money in the HISA as my non-equity (safe) allocation with the rest going to equities in my TD Waterhouse TFSA automatically each month. Equity (e.g. stocks, index funds, etc.) comes with a higher risk than debt (non-equity) investments (e.g. bonds, GICs, high interest savings accounts, etc.). This means that there is more volatility in equities and therefore, there is a stronger possibility of losing money in a small time period. However, index funds have proven to show steady gains over long periods of time (greater than 5 years) and have been proven to show much larger investment gains than any debt investments. I have taken a screenshot of the e-series index funds that I currently hold in my TD Direct Investing TFSA (see below). I hold the NASDAQ index fund and Canadian Bond index fund in very small amounts and are basically a negligible part of my portfolio (just have them to see how they are doing). The three index funds that I do hold in my portfolio in significant amounts are the:

-

Canadian Index, TDB900 (35% of portfolio) *MER % = 0.33

-

U.S. Index, TDB902 (35% of portfolio) *MER % = 0.35

-

International Index, TDB911 (30% of portfolio) *MER % = 0.50

MER % means management expense ratio. It is the fee that you will be charged for owning the funds and is calculated based on the percentage of the fund's average assets for the year (e.g. you will be charged 0.50% or $50 in fees on $10,000 invested in the International e-series Index since it has an MER % of 0.50). The fee includes the management fee, HST, day-to-day operating expenses to manage the fund (e.g. record keeping, audit and legal fees, annual reports, etc.). The higher the MER %, the higher the fees. So we want to keep these low!

When creating your portfolio, make sure that you are purchasing e-Series funds. The e-Series funds are the ones that are marked with an "-e". For example, TD CDN Index-e is an e-Series fund while TD CDN Index is a regular fund.

Q: Alright, I'm ready to buy! Right?

Pretty much! There's one more thing you should make note of before you do. The minimum amount required for initial and subsequent trades for TD e-series funds is $100. So you can't invest less than $100 into any one TD e-series fund directly through WebBroker (TD Direct Investing's online trading platform). However, if you set up a SIP (systematic investment plan) you will be able to invest a minimum of $25 into a TD e-series fund. Click here for a guide on how to do that.

If you think you're ready to buy, check this webpage out for a guide on how to do that.

Comments - Ask questions and/or provide feedback below!

*you can comment as a guest without registering/signing in by clicking on the 'Name' box below and checking the 'I'd rather post as a guest' box. If you don't feel comfortable providing your own email, you can just make one up (e.g. fakeemail@gmail.com).

DIY Canadian: How-To Guides for Canadians

DIY Canadian: How-To Guides for Canadians