Q: What's a credit score?

A credit score is a number that is given to you by credit-reporting agencies (such as Equifax and TransUnion in Canada) that indicates your credit trustworthiness. This number will be between 300 (worst) and 900 (best). Typically, a good score is considered to be anything above 680 and is generally considered the minimum score needed to obtain the best interest rates on mortgages. A poor score is anything below 620. Personally, I would try to keep your score above 700 at all times. It is likely that a score above 720 generally will have no beneficial impact on future credit applications. For exampe, if you have a score of 850 you won't get a better mortgage rate then someone who has a score of 720. This is not the case in the United States. In the US, you might get better rates or terms on a loan if you have a really good credit score (e.g. 850) compared to someone who has just a fine score (e.g. 720).

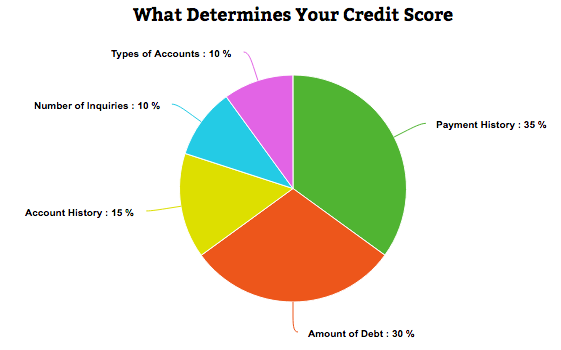

Your credit score is determined by a number of factors. It is based on your credit card history, cell phone plans, mortgage loans, etc. Although the formula used by bureaus to calculate your credit scores is not actually known and is kept secret, below you will find a general idea of how your credit score is calculated.

The biggest factor that influences your score (35% of how your score is calculated) is your 'payment history' and this is determined by whether or not you pay your credit cards off on time.

The 'amount of debt' (30% of how your score is calculated) is also a large factor and is determined by how much debt you have at the time that your score is checked.

Some smaller factors include your 'account history' (15% of how your score is calculated), 'number of inquiries' (10% of how your score is calculated) and 'types of accounts' (10% of how your score is calculated).

Check out the pie chart below to see a visual representation of how your credit score is determined:

'Account history' is largely based on the average age of your accounts. A higher average age is better than a lower one. This is why many people will tell you not to close your oldest credit card account (especially if it doesn't have an annual fee). It is also a good idea to keep any new credit card that you applied for open for at least 3-6 months (with 6 months being the safest bet) before closing the account. This will allow time for your credit card account to go from R0 status (account that is too new to rate) to R1 status (account that is in good standing) which looks better to lenders.

'Number of inquiries' is based on how often you apply for new products (e.g. new credit cards). Every time that you apply for a new credit card, you will get a 'hard pull' which means that a financial institution has looked at your credit report and score (with your permission). This will drop your credit score slightly. If you open a lot of new credit cards in a short period of time, this can be a warning sign for lenders as they may think that you are having financial issues. Keep in mind that when you are shopping for mortgages and/or home insurance, institutions will likely want to look at your credit score before approving you for a loan/rate. A 'hard pull' will be necessary when institutions are looking at your credit score, but it will only count as a single hit for your credit score regardless of how many institutions check out your credit report/score as long as your mortgage/home insurance shopping is all within two weeks of each other. Credit inquiries can stay on your report for 3-6 years, but older inquiries will have less of an impact on your score. Another option to avoid a credit inquiry when getting a new credit card is to 'product switch' (move from one credit card to another). Product switching can be done for sign up bonuses or you may want to move from a credit card with an annual fee to one that does not have fees.

A good mixture of 'types of accounts' will positively influence your credit score. For example, showing lenders that you are capable of paying off different types of loans (e.g. mortgage, cell phone plans, credit cards) can increase your credit score.

Q: Why should I care about my credit score?

In Ontario, your credit score could be checked by mortgage lenders (e.g. banks), landlords when finding a tenant, home insurance providers, employers, etc. This can have an affect on the mortgage rate your receive, the home insurance premium you have to pay, etc.

Q: What happens when I open a new credit card account?

Your credit score will potentially go down a bit when you open a new credit card account but it will be a small drop at most. A 'hard pull' will be necessary when opening a new account and so that could drop your credit score slightly. The average age of your accounts would also be lowered and could impact your credit score. However, these factors would only influence 25% of how your credit score is calculated so it would not be a devastating blow to your credit score.

Q: How do I find out my credit score? Does obtaining my credit score affect my credit score?

Obtaining your credit score is considered a 'soft pull' and will not negatively affect your credit score. You can obtain your credit report (without your credit score) for free from Equifax and/or TransUnion (*see the next question for more details on this). On the other hand, obtaining your credit score from Equifax ($11.95 one time payment with your credit report) or TransUnion ($19.95/month) will cost you money. However, there are some free options.

Some banks will allow you to check your credit score for free. For example, with CIBC, you can access your Equifax credit score with the CIBC Mobile Banking app (so you can only check with your phone). However, the CIBC credit score is only updated once every 3 months. Checking your Equifax credit score through the app does NOT negatively affect your credit score. Here is a link to the CIBC Free Credit Score Service for more information.

Some banks will allow you to check your credit score for free. For example, with CIBC, you can access your Equifax credit score with the CIBC Mobile Banking app (so you can only check with your phone). However, the CIBC credit score is only updated once every 3 months. Checking your Equifax credit score through the app does NOT negatively affect your credit score. Here is a link to the CIBC Free Credit Score Service for more information.

There are many companies that will provide your credit score for free. This is generally in exchange for signing up for something or providing some personal information. There is no such thing as a 'free lunch' in the credit score world so make sure you read through any agreements to obtain your credit score for free. Your information could be sold to a third party (which could lead to unwanted product offers) or worse (fraud). It is important to research the company that is providing you with the credit score to ensure you know what they are going to do with your information.

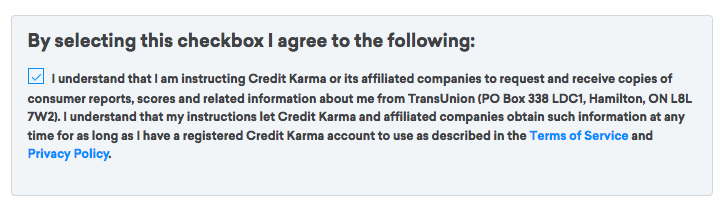

![]() If you are willing to go through a company to get your credit score for free, your safest bet at this current time is 'Credit Karma' (creditkarma.ca). If you use Credit Karma, you will receive your TransUnion credit score. Credit Karma says that the reason that they are able to provide you with a free TransUnion credit score is that when you sign up for their service, they (and any affiliated companies) can then use your credit report to see the credit cards that you could be approved for and make recommendations to you through advertising (for as long as you have a registered Credit Karma account).

If you are willing to go through a company to get your credit score for free, your safest bet at this current time is 'Credit Karma' (creditkarma.ca). If you use Credit Karma, you will receive your TransUnion credit score. Credit Karma says that the reason that they are able to provide you with a free TransUnion credit score is that when you sign up for their service, they (and any affiliated companies) can then use your credit report to see the credit cards that you could be approved for and make recommendations to you through advertising (for as long as you have a registered Credit Karma account).

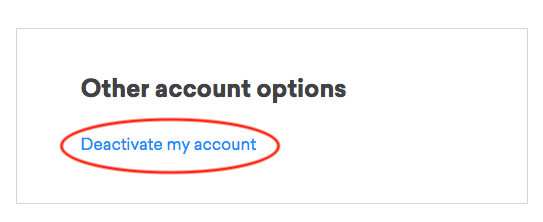

If you get one of the credit cards that they recommended to you through their referral link, the credit card provider will give Credit Karma some money. The founder of Credit Karma has stated that they don't sell or share your information unless you give explicit consent to do so (source). You are also NOT required to provide your Social Insurance number which is a huge safety bonus (just your name, address, phone number, DOB and email address are needed). I personally believe that the risk (which is essentially credit card advertising) is worth the reward (free TransUnion credit score that is updated weekly). If you decide you want to get rid of your Credit Karma account and to stop being advertised to, you can go to 'My profile' and click 'Deactivate my account' (see the picture below).

Q: What is a 'Credit Report' and why would I want it? Does obtaining my credit report affect my credit score?

Obtaining your credit report will not affect your credit score and it is FREE (so you might as well get it!). Your credit report provides information about every loan that you've taken out in the past six years (e.g. whether payments have been made on time, what is owed, etc.). The number of years is important because that is how long loan/credit history will stay on file and can be seen by potential lenders (e.g. banks, credit card companies, insurance providers, etc.). It also allows you to see if there are any mistakes on your credit report (and filing a dispute) so that you can clear them up before a mortgage lender checks into it. Your credit score will NOT appear on your credit report. You can obtain your credit report (without your credit score) for free from Equifax and/or TransUnion. Equifax calls this a 'Credit File Disclosure' and TransUnion calls this a 'Consumer Disclosure'. Neither credit bureau advertises this free service very well since they want you to buy instant access to your credit report instead. It is recommended that you get a credit report from both Equifax and TransUnion as they may have different information about how you have used credit in the past. Most people say that Equifax provides more detailed credit information since creditors are only required to report to one credit bureau and most report to Equifax over TransUnion (e.g. one credit report could include your mortgage while the other may not). It is important to note that ordering your own credit report has zero effect on your credit score so don't worry! TransUnion will allow you to order your credit report online once per year. For Equifax, you must receive your credit report by mail if you want to obtain it without paying money. I will show you the steps to get your credit report for free below.

OFFICAL ![]() DIY CANADIAN HOW TO: Obtaining Credit Reports in Ontario, Canada

DIY CANADIAN HOW TO: Obtaining Credit Reports in Ontario, Canada

Equifax

Let's start with Equifax and go over the options. You can either order an Equifax 'Credit File Disclosure' by submitting a form through mail/fax or you can order by telephone. Ordering by phone should be easier so that's what the first guide will show you how to do. However, I have personally had very frustrating experiences with the phone option and have always had to use the order by mail option in the end. Even when I follow the steps to perfection using the automated phone service, I am told that I am unsuccessful at the end of the phone call and have to mail in to order my credit report.

Equifax Option 1: Order your Credit Report by Phone

- Get your information ready

- You will need your Social Insurance Number and a credit card number to confirm your identity and find the correct credit file.

- Call Equifax

- Make sure that you have good cell phone reception and a quiet space when you make this call as the automated phone service will cancel your request if too many errors are made. You will also need to type in your credit card number fairly quickly as it will count it as an error if you are too slow. This can be frustrating!

- Call 1-800-465-7166.

- Answer the questions through the automated phone service

- You will need to answer a series of personal questions.

- The automated phone service should tell you whether your order was successful or unsuccessful

- If it was not successful, then the automated phone service will say that you need to order your credit report through mail or by fax. See option 2 if that's the case.

Equifax Option 2: Order your Credit Report by Mail/Fax

- Download the 'Canadian Credit Report Request Form'

- You can obtain the 'Canadian Credit Report Request Form' from Equifax by clicking on the link that is found on this webpage: https://help-en.equifax.ca/s/article/How-do-I-get-a-free-copy-of-my-Equifax-Canada-credit-file

- It should look like the form below. Click on the image to see the full document.

- Complete the 'Canadian Credit Report Request Form'

- In order to verifiy your identity, you must include photocopies of both the front and back sides of 2 pieces of government-issued IDs (e.g. driver's licence, health card, birth certificate, passport, etc.). If the address on these IDs is not up-to-date, then you will need to provide an additional document that shows your current home address such as a telephone/utility bill or bank satement (with transactional details blacked out since they only need the date of teh document, sender, name, address and account number).

- OPTIONAL: You can provide your Social Insurance Number and the name/last 4 digits of a major credit card you own to increase the speed/accuracy of the credit report order.

- OPTIONAL: On the request form, you can purchase your Equifax credit score for a one time fee of $11.95 with tax included by providing a VISA, MasterCard or AMEX number.

- Mail or Fax the 'Canadian Credit Report Request Form' with photocopies of your indentification

- Address your mail/fax to Nationl Consumer Relations

- If mailing the form, the address is:

National Consumer Relations

P.O. Box 190, Station Jean-Talon

Montreal, Quebec, H1S 2Z2 - You can fax your information to 514-355-8502. If you have access to a fax machine then this is the easier option. Your local library will often provide a fax service for a small fee (my local library charges $2 for the first page and then $1 for every page after that) and is probably worth avoiding the hassle of mailing the request form.

- Wait for the Credit Report to me mailed to your home address

- Equifax will mail your credit report within 5-10 days of receiving the request form.

- OPTIONAL: Dispute your Credit Report

- If there is information on your credit report that you do not agree with, you will be required to complete the 'Credit Report Update' form that is enclosed with the package that is mailed out to you and mailing/faxing it back to Equifax. You can also get this form by visiting equifax.ca and clicking on "Correct an inaccuracy on my credit report" under Credit Report Assistance. You will still be required to mail/fax the form to Equifax (along with 2 pieces of government-issued ID and other information that helps to prove that a dispute is valid)

TransUnion

You can order a TransUnion 'Consumer Disclosure' online (once per year), by mail or in person. The online option is the easiest and best way to get your report so that is the guide I will provide you with below.

TransUnion Option 1: Order your Credit Report Online *once per year

- Go to the TransUnion website and go to the Consumer Disclosure product page

- The direct link for the Consumer Disclosure webpage is https://www.transunion.ca/product/consumer-disclosure

- Once on this page, scroll down and click on the 'online access' link. On the next page, click on the link to 'Access your Consumer Disclosure today!' You should end up at this webpage: https://secure-ocs.transunion.ca/secureocs/credit-agree.html?lang=en

- Complete the 3-Step Process to Obtain your Credit Report

- Step 1: You will need to fill out some personal information about yourself. Providing your Social Insurance Number (SIN) will help you get matched with your credit card more easily but is not required.

- Step 2: You will need to answer some personal questions that will are designed to ensure that you are actually who you say you are (e.g. current age, last credit on file, type of credit card that you have, etc.).

- Step 3: You will have an option to view the 'Consumer Disclosure' PDF in the browser (if you have a PDF plugin) or download the file so that you can view it later (recommended). You will only be allowed to stay on this page for 15 minutes so make sure that you download the file right away.

- Understand Your Credit Report

- TransUnion provides a link that will help explain to you what everything means on your credit report. Go to https://ocs.transunion.ca/ocs/understanding.html?lang=en to find out more

- OPTIONAL: Dispute your Credit Report

- If there is something on your credit report that you don't agree with then go to this link to see the different actions that you can take https://www.transunion.ca/assistance/credit-report-disputes

- The easiest option is to phone in to TransUnion's Consumer Relations Department at 1-800-663-9980 if you have a dispute. They are available is between Monday and Friday from 8 am to 8 pm.

Comments - Ask questions and/or provide feedback below!

*you can comment as a guest without registering/signing in by clicking on the 'Name' box below and checking the 'I'd rather post as a guest' box. If you don't feel comfortable providing your own email, you can just make one up (e.g. fakeemail@gmail.com).

DIY Canadian: How-To Guides for Canadians

DIY Canadian: How-To Guides for Canadians